THE GREAT

REBALANCING ACT

Why tech is focused on profitability rather than

growth, and why this is good for the industry

THE GREAT

REBALANCING ACT

Why tech is focused on profitability rather than growth, and why this is good for the industry

For more than a decade, tech companies have prioritized growth, focusing investor attention on metrics of "scale" intended to translate into profitability. This high-growth philosophy has been embraced by markets, but as economic conditions become more challenging, tech companies must confront a harsh reality: their growth patterns might not be sustainable.

The sector must balance performance on both the top and bottom lines. If willing to adapt, tech can come out stronger. If unwilling to do so, many tech darlings risk losing their exuberant valuations and may be forced to confront an underlying existential question for any business: can they sustainably generate enough free cash flow on their own to survive?

INSIGHTS FROM OUR 2023 SURVEY

Read our full report to learn more about the challenges facing tech beyond 2023 and how companies in the space can deliver growth while increasing profitability.

INSIGHTS FROM OUR 2023 SURVEY

Read our full report to learn more about the challenges facing tech beyond 2023 and how companies in the space can deliver growth while increasing profitability.

KEY HIGHLIGHTS

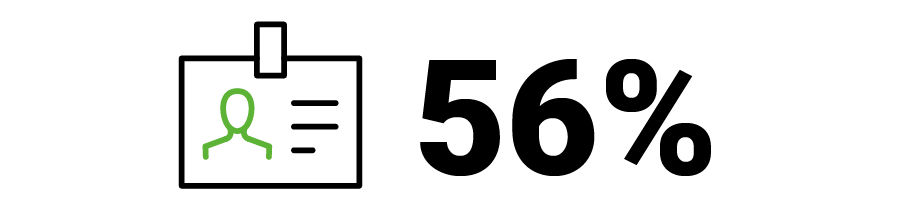

Over the last 24 months, 56% of tech executives have prioritized profitability over or equal to growth.

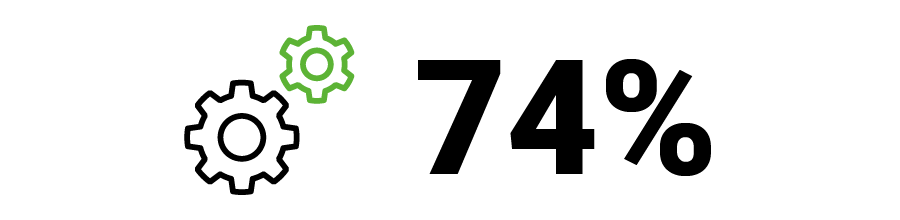

Over the coming 24 months, almost three quarters (74%) of tech leadership teams will focus on profitability over or equal to growth.

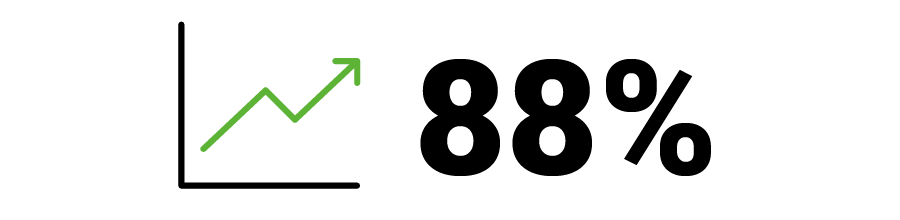

88% of executives expect to accelerate profitability improvements and cost-management strategies due to the shifting market.

We find that company size is a major factor in setting key performance targets:

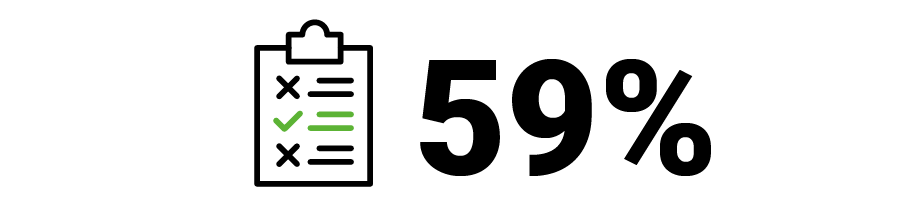

More than half (59%) of all tech companies surveyed by AlixPartners have lowered growth targets.

72% of tech giants with revenues exceeding $5B have eased growth targets amid current economic conditions.

In contrast, the majority (55%) of smaller tech companies earning less than $100M in revenue still prioritize growth targets.

DRIVERS OF CHANGE

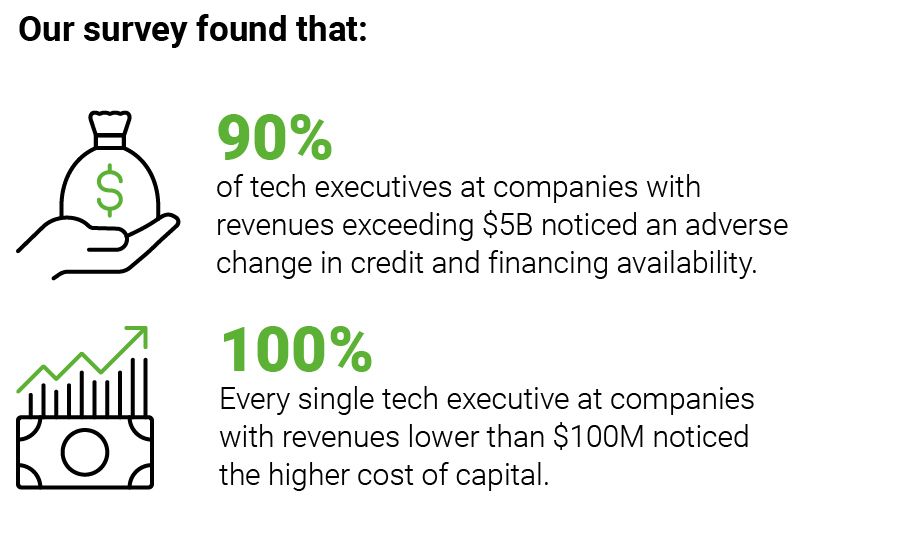

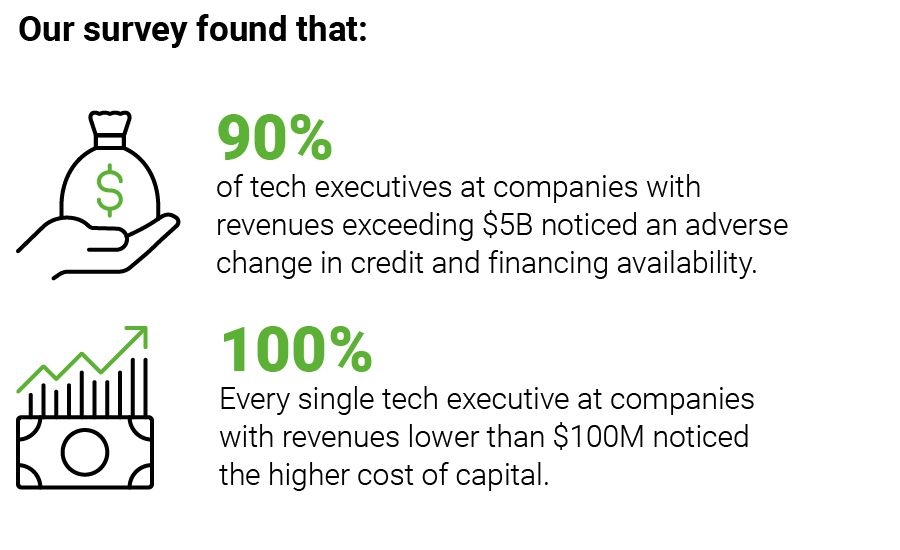

An escalating cost of capital

The U.S. Federal Reserve continues to be uncompromising in its battle against inflation. Hawkish rate hikes have made cash more expensive, pushed the cost of debt higher, and simultaneously created higher-return, low-risk bond alternatives for investors – reason to demand extra from high-risk tech propositions. With outside financing quickly drying up for the sector, it must prove itself once over and show that it can be self-sufficient in generating the funds needed to sustain growth momentum. Learn more.

An escalating cost of capital

The U.S. Federal Reserve continues to be uncompromising in its battle against inflation. Hawkish rate hikes have made cash more expensive, pushed the cost of debt higher, and simultaneously created higher-return, low-risk bond alternatives for investors – reason to demand extra from high-risk tech propositions. With outside financing quickly drying up for the sector, it must prove itself once over and show that it can be self-sufficient in generating the funds needed to sustain growth momentum. Learn more.

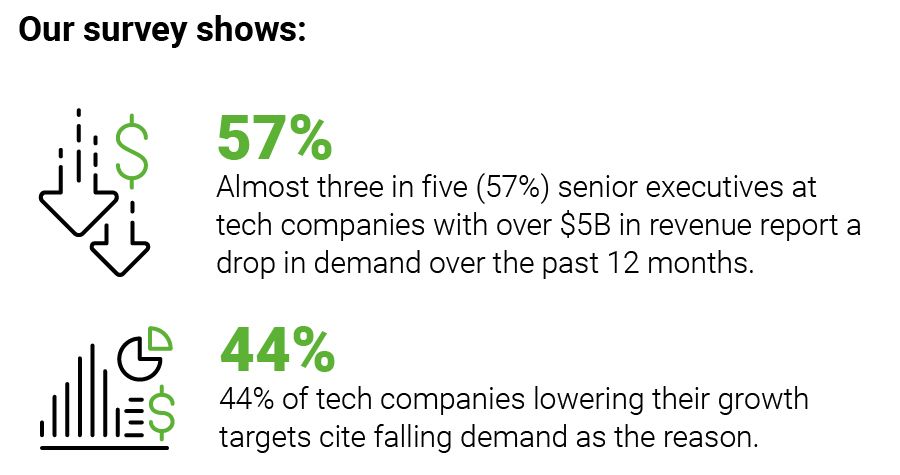

Economic uncertainty stifles demand

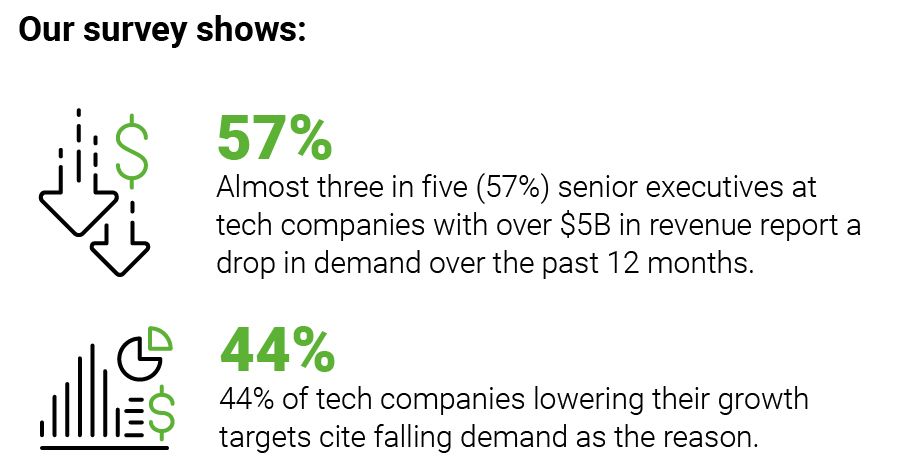

It does not help matters that an inflationary backdrop and higher costs of doing business mean that consumers and enterprises alike are keen to rein in their spending and be more efficient with service usage.

The rapid digital transformation of the workplace, accelerated by the pandemic, has acted as an important tailwind for the growth of the technology sector. However, AlixPartners understands that even hyperscalers are no longer benefiting from this demand trend. In reality, we find in our report that customers are consolidating costs and smartening up to where there may be excess spending on IT and cloud services in their operations. Learn more.

Economic uncertainty stifles demand

It does not help matters that an inflationary backdrop and higher costs of doing business mean that consumers and enterprises alike are keen to rein in their spending and be more efficient with service usage.

The rapid digital transformation of the workplace, accelerated by the pandemic, has acted as an important tailwind for the growth of the technology sector. However, AlixPartners understands that even hyperscalers are no longer benefiting from this demand trend. In reality, we find in our report that customers are consolidating costs and smartening up to where there may be excess spending on IT and cloud services in their operations. Learn more.

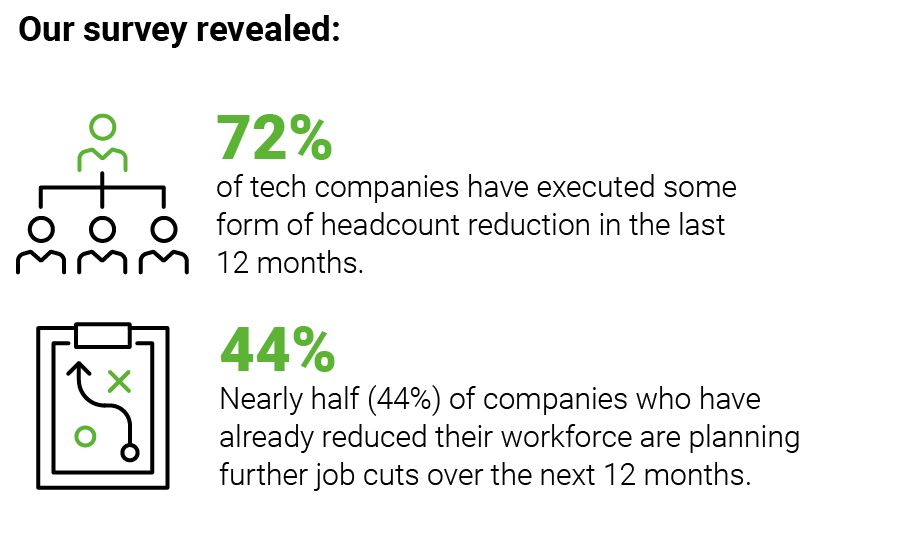

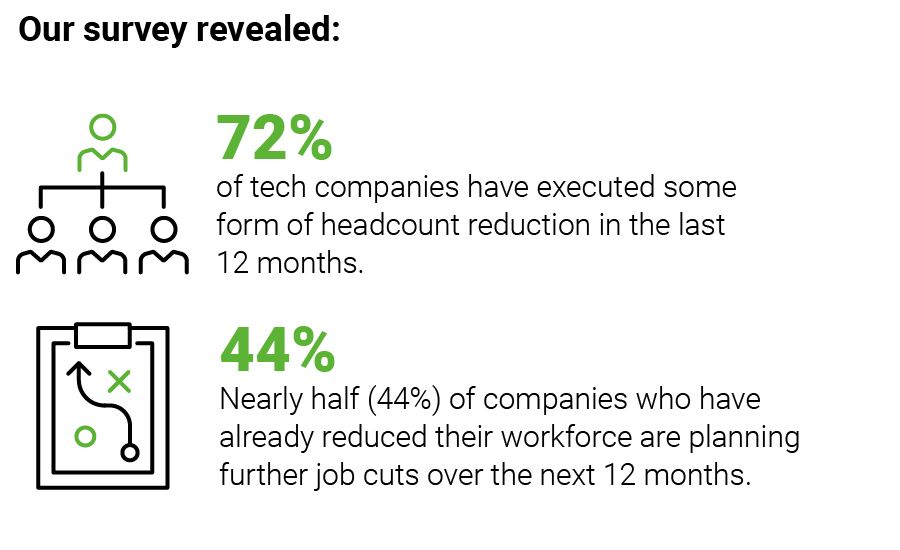

Correcting course from pandemic era overhiring

One of the most controversial talking points since the end of the pandemic has been the many, many thousands of job losses suffered in the tech sector (350,000 and counting since the start of 2022). Unfortunately, undoing the overhiring that occurred during this period of unprecedented demand is a fast and effective measure to reduce expenses now that priorities have changed – 2023 has seen even more layoffs than 2022. In conjunction with further rightsizing expected in 2024, tech executives are appealing for innovative ideas that will aid long-term operational performance while inflicting less damage to morale. Learn more.

Correcting course from pandemic era overhiring

One of the most controversial talking points since the end of the pandemic has been the many, many thousands of job losses suffered in the tech sector (350,000 and counting since the start of 2022). Unfortunately, undoing the overhiring that occurred during this period of unprecedented demand is a fast and effective measure to reduce expenses now that priorities have changed – 2023 has seen even more layoffs than 2022. In conjunction with further rightsizing expected in 2024, tech executives are appealing for innovative ideas that will aid long-term operational performance while inflicting less damage to morale. Learn more.

FIXING THE PROFITABILITY ENGINE

AlixPartners has developed an assembly of initiatives for both young tech start-ups and multibillion-dollar enterprises to optimize operational performance, without sacrificing growth potential. We believe that juggling the two is an eminently achievable feat, and in this report, we detail a complete portfolio of measures to streamline busy organizations and trim cost bases 20-30% over the long-term.

We encourage executives to strictly allocate resources to activities offering the highest returns on invested capital (ROIC). To boot, AI holds immense potential to cover for human talent which can be redirected to higher-ticket projects. To make every dollar stretch as the economic cycle turns, we advocate for sales, customer success, and product teams to collaborate in joint reviews of many performance metrics. R&D workflows are another key area to find efficiencies and take actions designed not only to cut overspend and enhance profitability, but to get tech teams in leaner shape to capitalize on future growth opportunities.

INSIGHTS FROM OUR 2023 SURVEY

Read our full report to learn more about the challenges facing tech beyond 2023 and how companies in the space can deliver growth while increasing profitability.

INSIGHTS FROM OUR 2023 SURVEY

Read our full report to learn more about the challenges facing tech beyond 2023 and how companies in the space can deliver growth while increasing profitability.