SUPPLY CHAINS

Proactivity and pace can secure the most critical business asset

SUPPLY CHAINS

Proactivity and pace can secure the most

critical business asset

Mitigating today’s unprecedented pressures on global trade is as complex as it’s ever been. The omnipresence of global issues means that yesterday’s solutions are blunt instruments today. Business leaders must make more fundamental shifts in company operations to help reduce the impact of this flurry of megatrends.

In addition to sourcing timelines impacted by congestion at ports worldwide, firms are having to deal with whipsawing commodity prices, the fallout from Russia’s war with Ukraine, tenuous labor markets, and rapid changes in consumer spending, as households tighten their belts in the face of rising inflation.

Given this, business leaders need to take a longer-term look at their supply chains and make bold strategic decisions to overcome pain points that are likely to persist for years to come.

Indeed, today’s leaders are evaluating new ideas that go as far as to alter the way firms strike deals with customers, the size and location of production and manufacturing facilities, and the lines of business that companies pursue.

No escape

Time and cost remain the key factors behind any supply chain. That said, skyward commodity prices and the perpetual battle of shipping and logistics firms to overcome built-up demand from global lockdowns mean that firms need to develop plans to help mitigate these macro issues.

Every industry is affected, so there’s no place to hide. Firms like shipbuilders, whose costs are intrinsically linked to the global price of commodities, are witnessing input cost rises of hundreds of millions of dollars. This amplifies the common industry-specific issue of thin margins and fixed-price contracts.

For sectors such as retail, the rise in transport costs caused by the spike in oil and gas prices is certainly an issue. But perhaps a more awkward hurdle to jump is the one of lengthening lead times.

Getting products from overseas is taking longer, meaning that sourcing teams who are used to ordering products six months in advance are now having to do so at least nine months ahead, if not 12.

Predicting what the next ‘hot item’ will be a year from now is a huge challenge for retailers, as it increases the risk of being stuck with unsellable stock and ties up working capital for longer. This in turn impacts net debt and potentially causes other financial strains. Furthermore, given the pernicious impact of inflation, consumers are rapidly changing their buying habits to accommodate the associated squeeze on disposable incomes.

Significant shifts

Cost benefits of cheap production hubs have been eroded by spiraling transport costs, making it potentially compelling for firms to reconsider their geographic footprint and make more products closer to customers. This tactic strengthens the link between the cost base and revenue base, insulating firms against some volatility in transport costs and foreign exchange fluctuations. Larger inventory is applying further pressure to working capital and weakening balance sheets with an increased risk of mark-downs, particularly for mid-market or seasonally driven retailers.

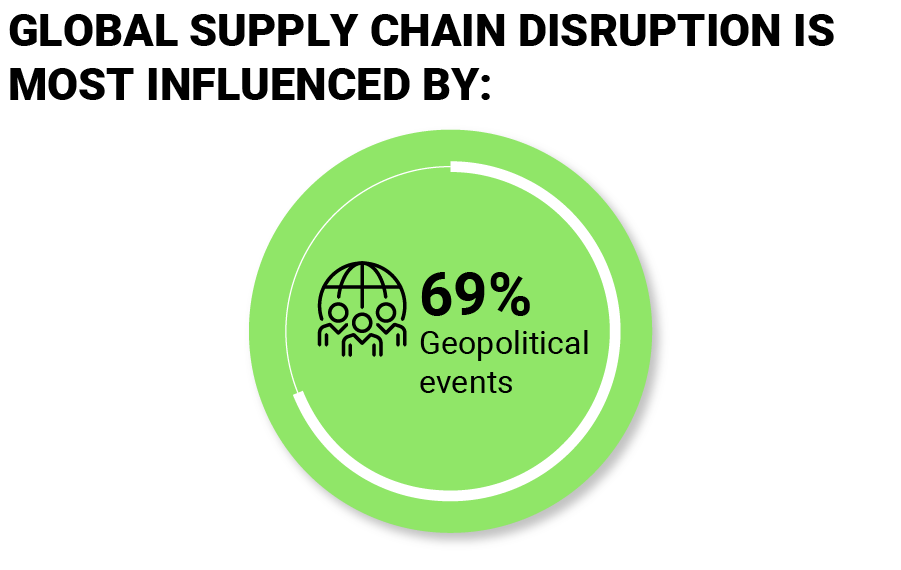

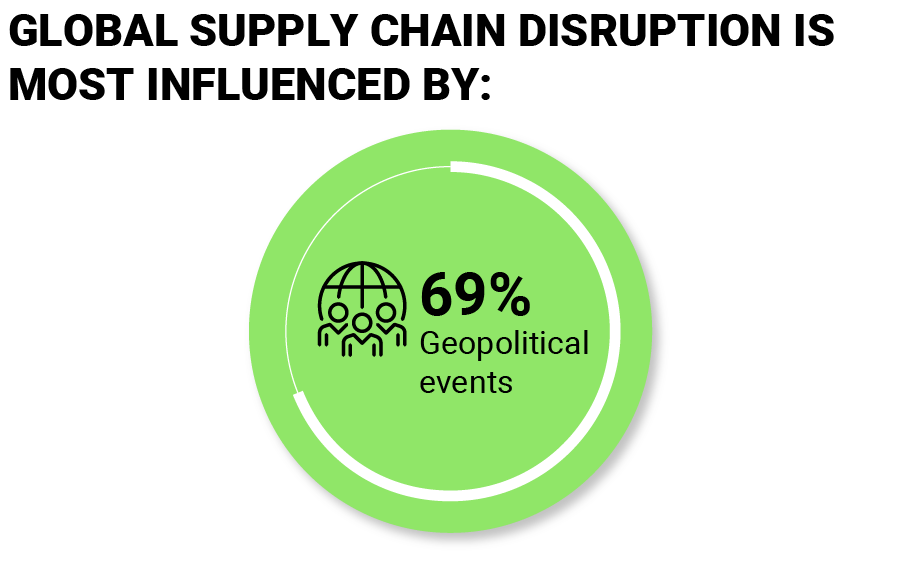

Downsizing or closing a production facility doesn’t happen quickly, but geopolitical risk, which is fueling energy price spikes and inflation more broadly, is likely to persist for the long term.

Significant shifts

Cost benefits of cheap production hubs have been eroded by spiraling transport costs, making it potentially compelling for firms to reconsider their geographic footprint and make more products closer to customers. This tactic strengthens the link between the cost base and revenue base, insulating firms against some volatility in transport costs and foreign exchange fluctuations. Larger inventory is applying further pressure to working capital and weakening balance sheets with an increased risk of mark-downs, particularly for mid-market or seasonally driven retailers.

Downsizing or closing a production facility doesn’t happen quickly, but geopolitical risk, which is fueling energy price spikes and inflation more broadly, is likely to persist for the long term.

Supply chains are about serving demand, and businesses have a challenge on that side too. During the pandemic, when travel and leisure was largely or even entirely curtailed, household saving rates broadly rose, leading to a boom in online spending for home goods and services. But with restrictions now mostly eased, the high-selling business lines of lockdowns are now no longer as popular.

Further muddying the picture is inflation, whose severity and longevity is impossible to predict.

The prospect of rising interest rates, aimed at curbing inflation, could amplify monthly outgoings for households. Meanwhile, suggestions that globalization (widely regarded as a deflationary force) could be going into reverse hint at elevated prices for goods in the long term.

Proactive strategies

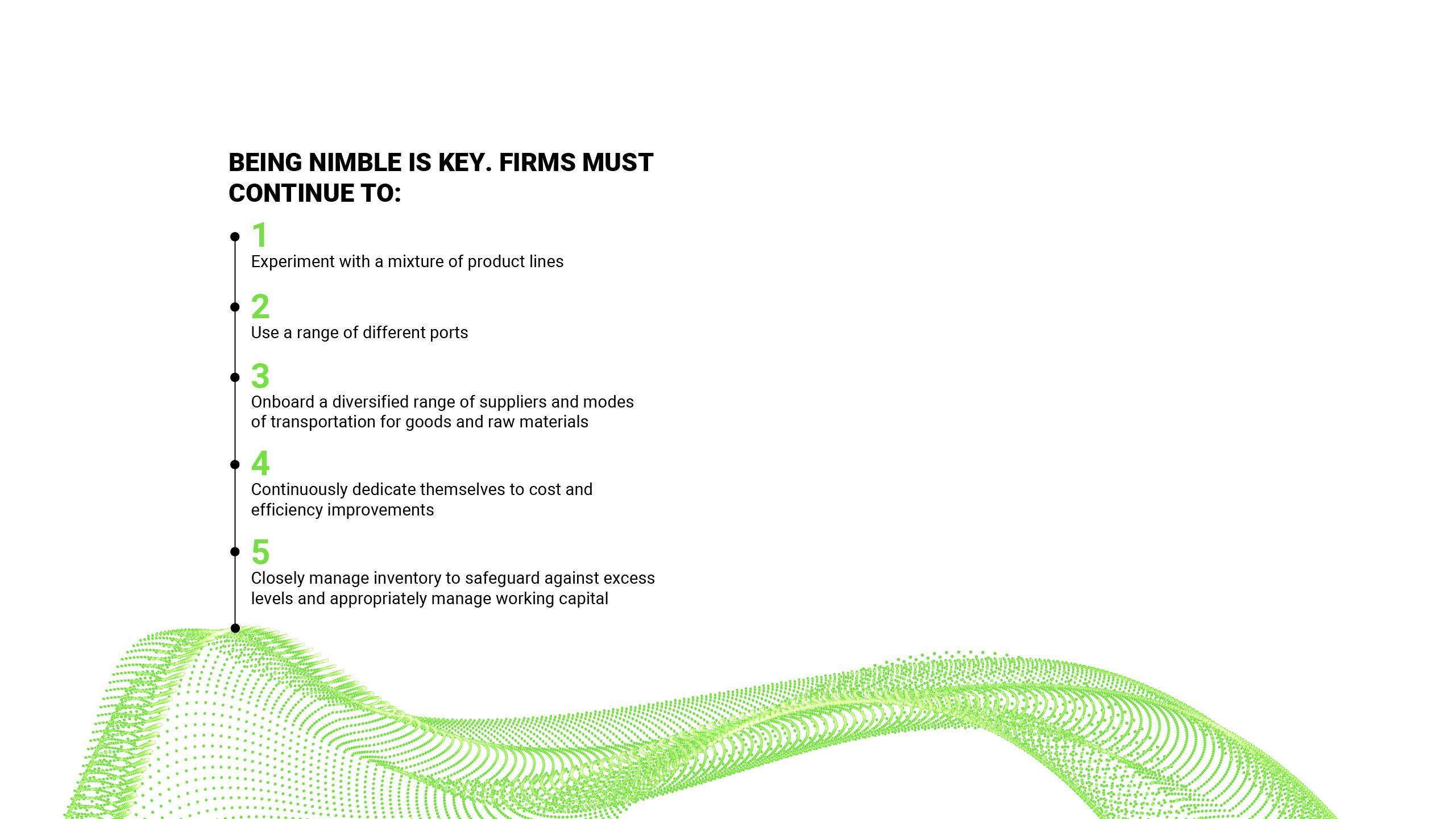

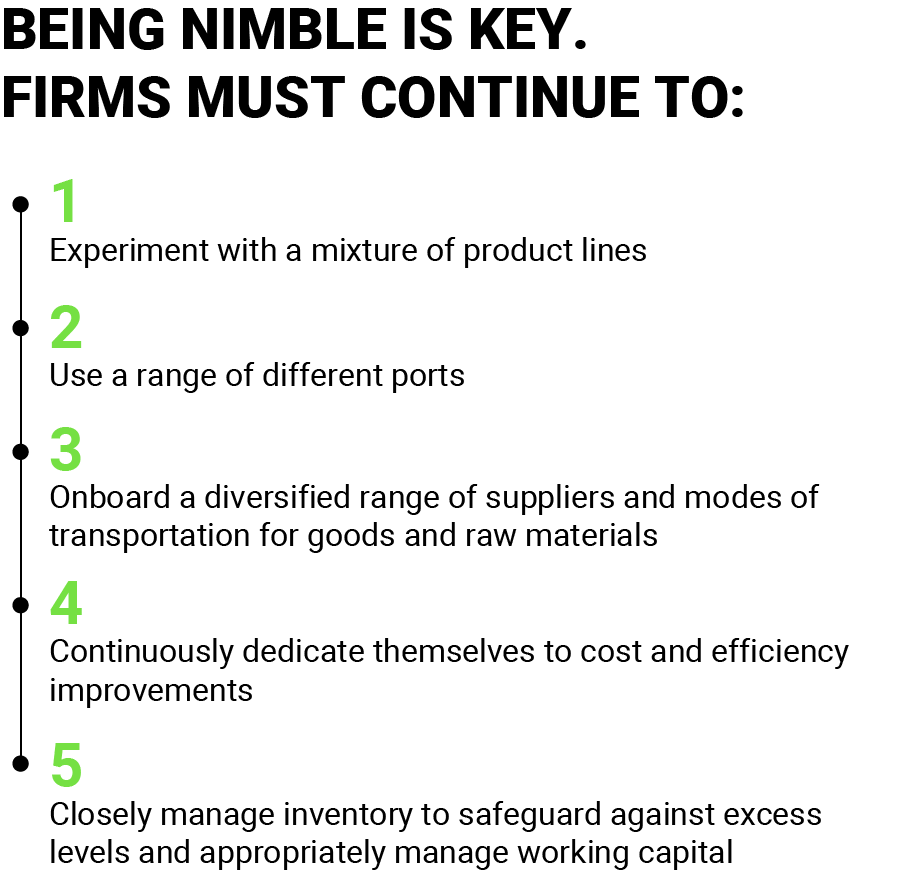

In some ways, nothing has changed in the way firms need to deal with supply chain issues, but in others, nothing is the same.

The benefits of these “solutions” may not be realized as quickly as they once were, and also may now apply to much larger-scale decision-making. For instance, just a few years ago, greater agility might have resembled small-scale changes to suppliers or product lines. Now it means making decisions fast about where to base entire production hubs.

Furthermore, paying more for transportation may simply mean a greater chance of items arriving sooner rather than guaranteeing it. By the same token, industrial firms reliant on raw materials but with fixed-price contracts may need to innovate by implementing escalator or de-escalator clauses if the prices of underlying commodities drastically change.

Essentially, firms that wait and hope for conditions to ease are likely to suffer more than those that take decisive action now, with security of supply fast becoming one of the most highly sought-after business assets.

Proactive strategies

In some ways, nothing has changed in the way firms need to deal with supply chain issues, but in others, nothing is the same.

The benefits of these “solutions” may not be realized as quickly as they once were, and also may now apply to much larger-scale decision-making. For instance, just a few years ago, greater agility might have resembled small-scale changes to suppliers or product lines. Now it means making decisions fast about where to base entire production hubs.

Furthermore, paying more for transportation may simply mean a greater chance of items arriving sooner rather than guaranteeing it. By the same token, industrial firms reliant on raw materials but with fixed-price contracts may need to innovate by implementing escalator or de-escalator clauses if the prices of underlying commodities drastically change.

Essentially, firms that wait and hope for conditions to ease are likely to suffer more than those that take decisive action now, with security of supply fast becoming one of the most highly sought-after business assets.