INFLATION

A perfect storm requires planning

and pricing to match

INFLATION

A perfect storm requires planning

and pricing to match

Asked to name the greatest challenge for political leaders, British Prime Minister Harold Macmillan famously replied, “Events, dear boy, events.”

Business leaders may sympathize: After all, in 2021’s Turnaround and Transformation Survey, most respondents predicted that inflation would likely rise but interest rates remain low. The consensus that price rises would be benign and temporary might even have been borne out – despite trends in commodity prices in the latter half of 2021 – if not for events in Eastern Europe.

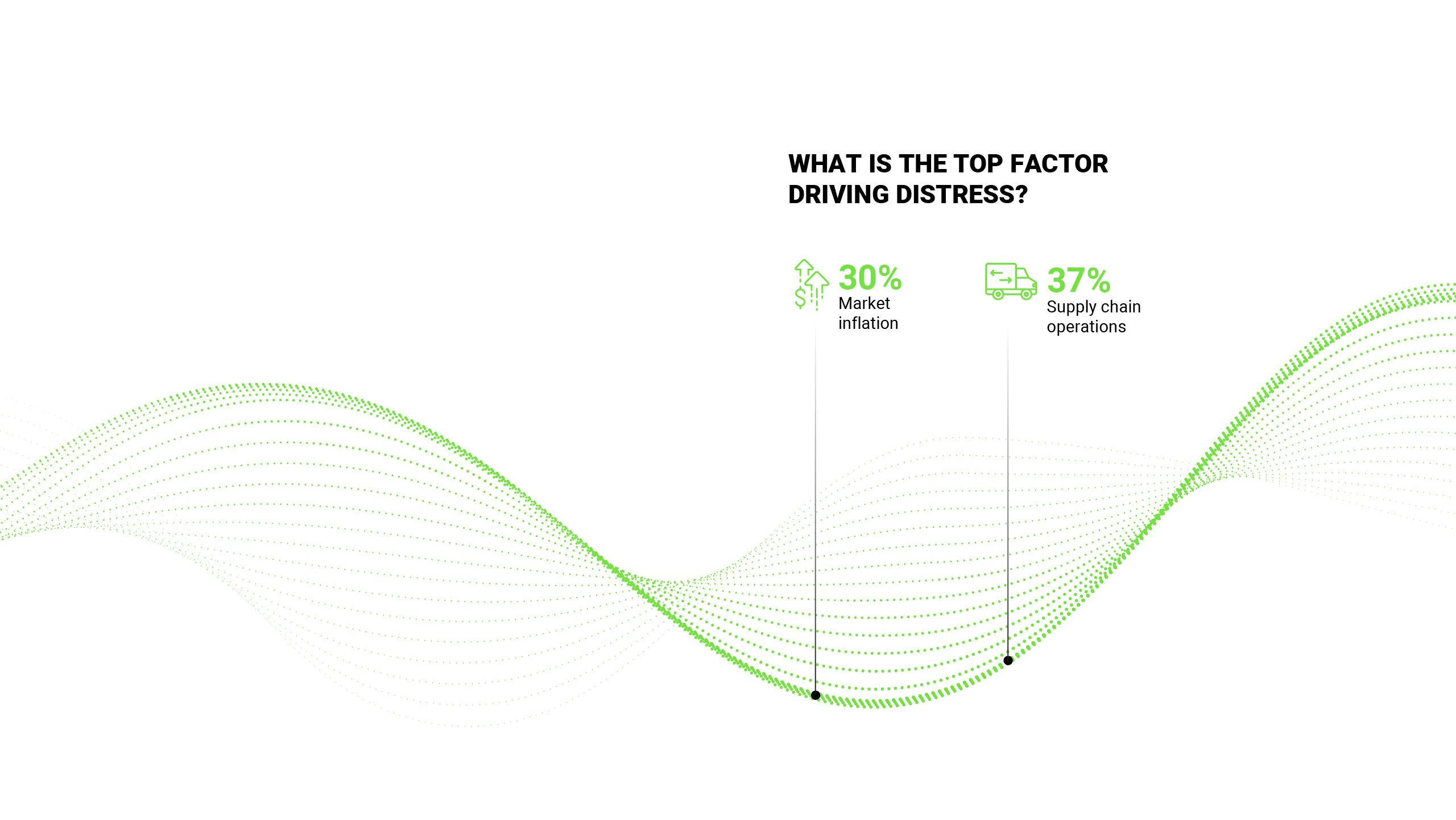

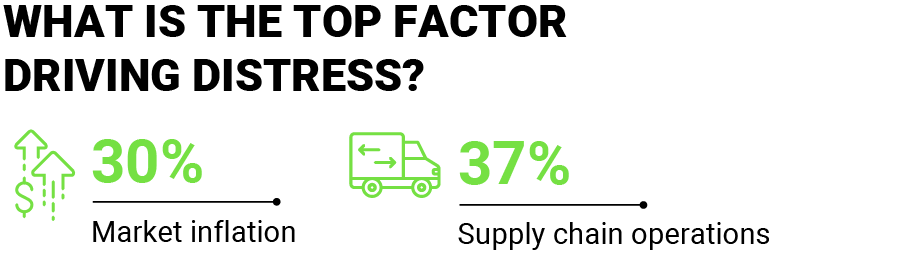

With the war in the Ukraine creating even greater pressure on already high energy prices, it is hardly a surprise that this year’s survey cites market inflation as second only to supply chain disruption as a short-term driver of corporate distress. In the UK and the Americas, it was top of the list. And in all geographies, respondents put forward inflation as the number one challenge facing the global economy in the long term.

We agree that elevated inflation is unlikely to recede in the short term. While we may well be past the point of crisis by the end of the year, it is reasonable to expect 2023 will witness price rises significantly above what we had come to regard as normal in recent decades. C-suites will need to plan for a range of inflationary scenarios in the years to come. But for many, surviving the immediate consumer spending crunch will understandably be front of mind.

Asked to name the greatest challenge for political leaders, British Prime Minister Harold Macmillan famously replied, “Events, dear boy, events."

Business leaders may sympathize: After all, in 2021’s Turnaround and Transformation Survey, most respondents predicted that inflation would likely rise but interest rates remain low. The consensus that price rises would be benign and temporary might even have been borne out – despite trends in commodity prices in the latter half of 2021 – if not for events in Eastern Europe.

With the war in the Ukraine creating even greater pressure on already high energy prices, it is hardly a surprise that this year’s survey cites market inflation as second only to supply chain disruption as a short-term driver of corporate distress. In the UK and the Americas, it was top of the list. And in all geographies, respondents put forward inflation as the number one challenge facing the global economy in the long term.

We agree that elevated inflation is unlikely to recede in the short term. While we may well be past the point of crisis by the end of the year, it is reasonable to expect 2023 will witness price rises significantly above what we had come to regard as normal in recent decades. C-suites will need to plan for a range of inflationary scenarios in the years to come. But for many, surviving the immediate consumer spending crunch will understandably be front of mind.

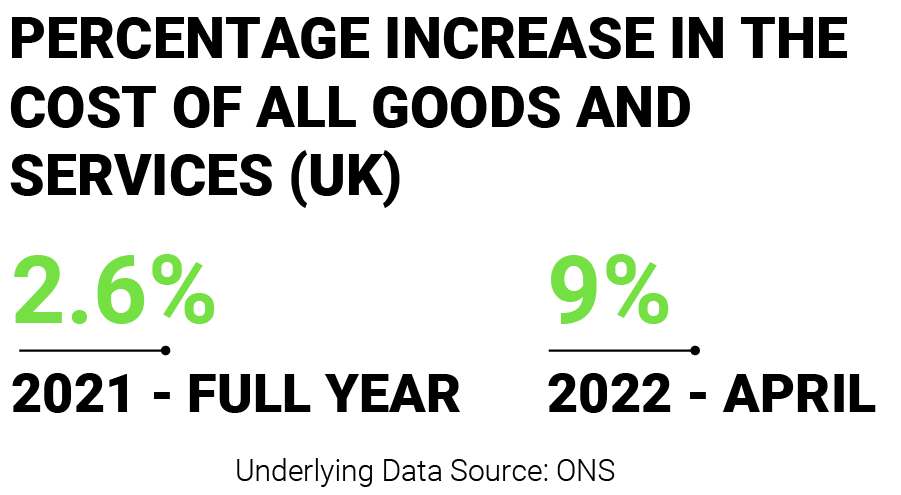

The challenge should not be underestimated, as our work on the impact of inflation in the UK shows. At the time of writing, the Consumer Prices Index was rising 9% year-on-year and is forecast to peak at 11%. But we calculate that “essential spend” inflation – the likes of food, housing, and heating – is more like 12% to 13%. Essential spend accounts for more than half of household budgets. Since people have little choice but to meet these costs, and wages are not keeping pace, the result is a discretionary spending reduction of perhaps 17%. This in turn is a worrying statistic to see for businesses in travel, hospitality, and consumer goods.

The challenge should not be underestimated, as our work on the impact of inflation in the UK shows. At the time of writing, the Consumer Prices Index was rising 9% year-on-year and is forecast to peak at 11%. But we calculate that “essential spend” inflation – the likes of food, housing, and heating – is more like 12% to 13%. Essential spend accounts for more than half of household budgets. Since people have little choice but to meet these costs, and wages are not keeping pace, the result is a discretionary spending reduction of perhaps 17%. This in turn is a worrying statistic to see for businesses in travel, hospitality, and consumer goods.

The number one tactic in the inflation defense playbook is to pass cost increases through to customers. Not all businesses can resort to the obvious though. We encounter suppliers contractually limited to, for example, only annual price increases. This can mean long, worrying months of margin erosion as companies find themselves trapped between the rock of rising input costs and the hard place of static pricing.

Others can pass costs through but are poorly placed to do so efficiently. In consumer products, for example, a granular understanding of internal data is essential. Companies that struggle with information on profitability at SKU level will not respond quickly enough to maintain margin on individual lines.

Retail presents different challenges. Success here depends, in part, on strategic decision-making on the price point for high-visibility products. Retailers that can hold down prices the longest can expect to gain market share: Whoever moves last wins. We therefore expect those with the deepest pockets to thrive.

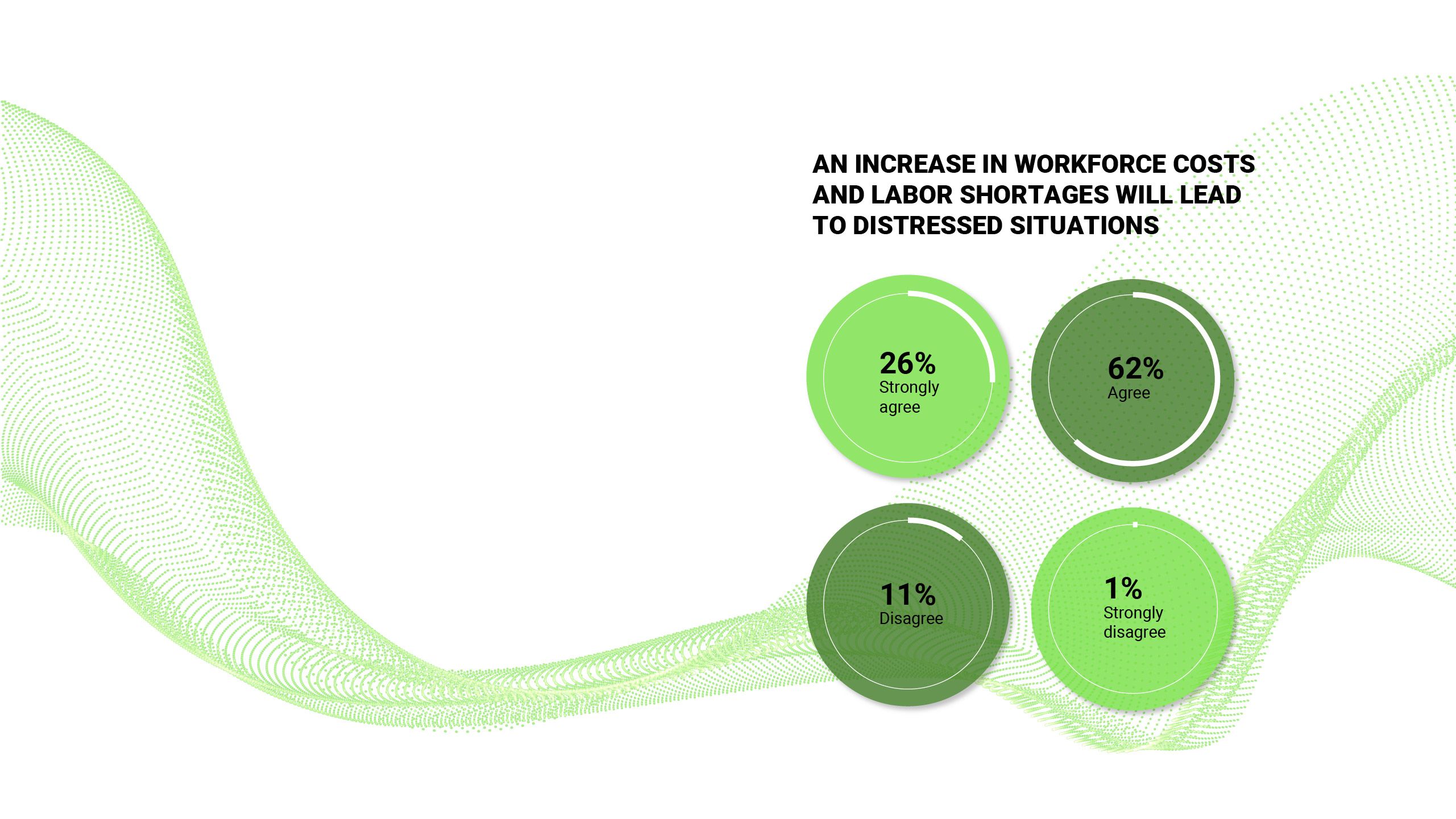

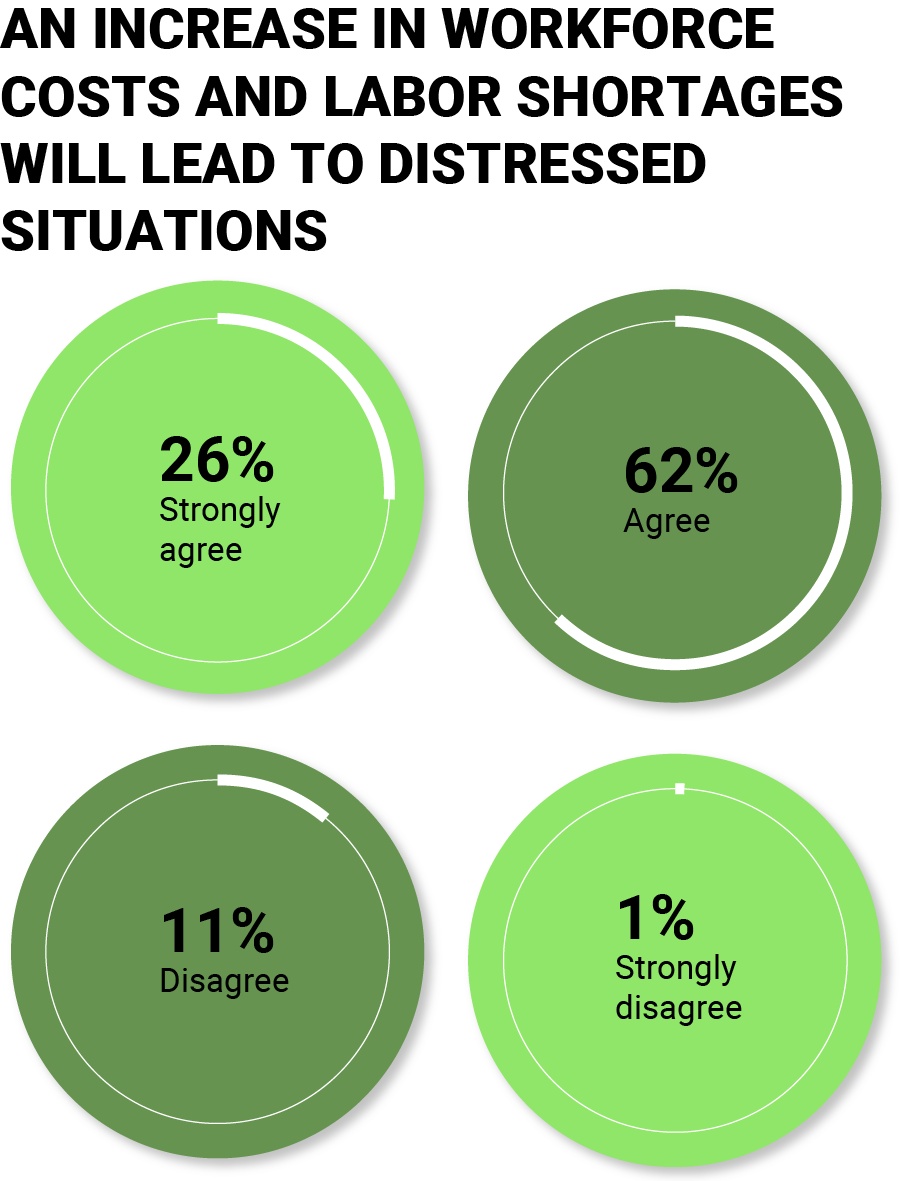

What of cost control? This is particularly relevant in growth stage tech, where capital allocation is fast drying up and founders are adjusting to the realization that the cavalry is not coming over the hill with low-cost, easy funding. Reducing costs to buy time for market conditions to ease can be the difference between survival and otherwise, in this and other sectors. The challenge here is a certain myopia about labor costs: Executives are heavily focused on recruitment and retention, which is understandable given the extraordinarily tight labor market. But this can distract from the pressing need to ensure that organizations are the right size for leaner days.

The time to act is now. Highly leveraged companies have been cushioned up to this point by cash piles raised, then not burned, during the early pandemic days. Credit markets have been accordingly forgiving. As risk appetites shrink, however, many lenders are now going back to basics. Corporates must prepare for much more rigorous engagement with credit markets – and soon.

Retail presents different challenges. Success here depends, in part, on strategic decision-making on the price point for high-visibility products. Retailers that can hold down prices the longest can expect to gain market share: Whoever moves last wins. We therefore expect those with the deepest pockets to thrive.

What of cost control? This is particularly relevant in growth stage tech, where capital allocation is fast drying up and founders are adjusting to the realization that the cavalry is not coming over the hill with low-cost, easy funding. Reducing costs to buy time for market conditions to ease can be the difference between survival and otherwise, in this and other sectors. The challenge here is a certain myopia about labor costs: Executives are heavily focused on recruitment and retention, which is understandable given the extraordinarily tight labor market. But this can distract from the pressing need to ensure that organizations are the right size for leaner days.

The time to act is now. Highly leveraged companies have been cushioned up to this point by cash piles raised, then not burned, during the early pandemic days. Credit markets have been accordingly forgiving. As risk appetites shrink, however, many lenders are now going back to basics. Corporates must prepare for much more rigorous engagement with credit markets – and soon.