CORPORATE

FINANCE

Realism and speed to action is required to counter the rising cost of debt

CORPORATE

FINANCE

Realism and speed to action is required

to counter the rising cost of debt

There is a distinct touch of frost in the macroeconomic air.

We expect to see a rise in corporate distress and restructuring activity as heavily leveraged companies emerge from the years of cheap credit and government interventions into a less forgiving era.

With interest rates rising – gradually in the Eurozone, more quickly in the US and UK – debt burdens weigh more heavily, and “amend and extend” deals no longer seem attractive. Such can-kicking is increasingly giving way to action to resurface companies from under debt piles.

Not all will find it easy. We may witness distress among “zombie companies” previously able to muddle through on easy credit.

The extent will vary by jurisdiction: For example, in Germany, government loans, subsidies and employment support have continued into 2022. Not so the forbearance of lenders, who across continental Europe are gradually repositioning from the pandemic consensus that the responsible approach was to stick by clients with non-performing loans.

Many businesses are in the eye of the storm. The COVID-specific economic crisis may be largely over, but inflation is still gathering pace. Sectors such as retail and travel, hospitality, and leisure are awaiting a consumer spending crunch that, at the time of writing, is widely expected but has yet to materialize in top lines. Meanwhile, geopolitical events continue to menace supply chains and energy security, particularly in Europe.

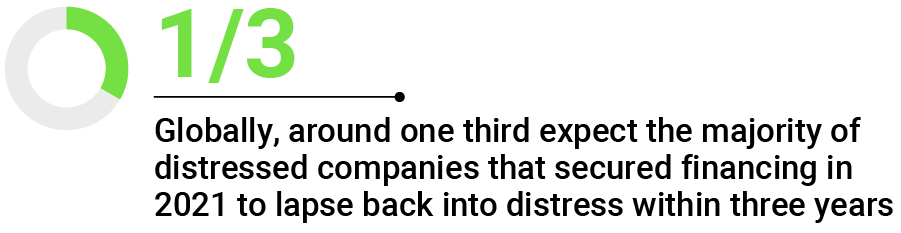

Against this backdrop, a number of our survey results make for concerning reading. Almost 30% of respondents said that the majority of their clients had used liquidity markets to extend their runway without tackling underlying operational issues.

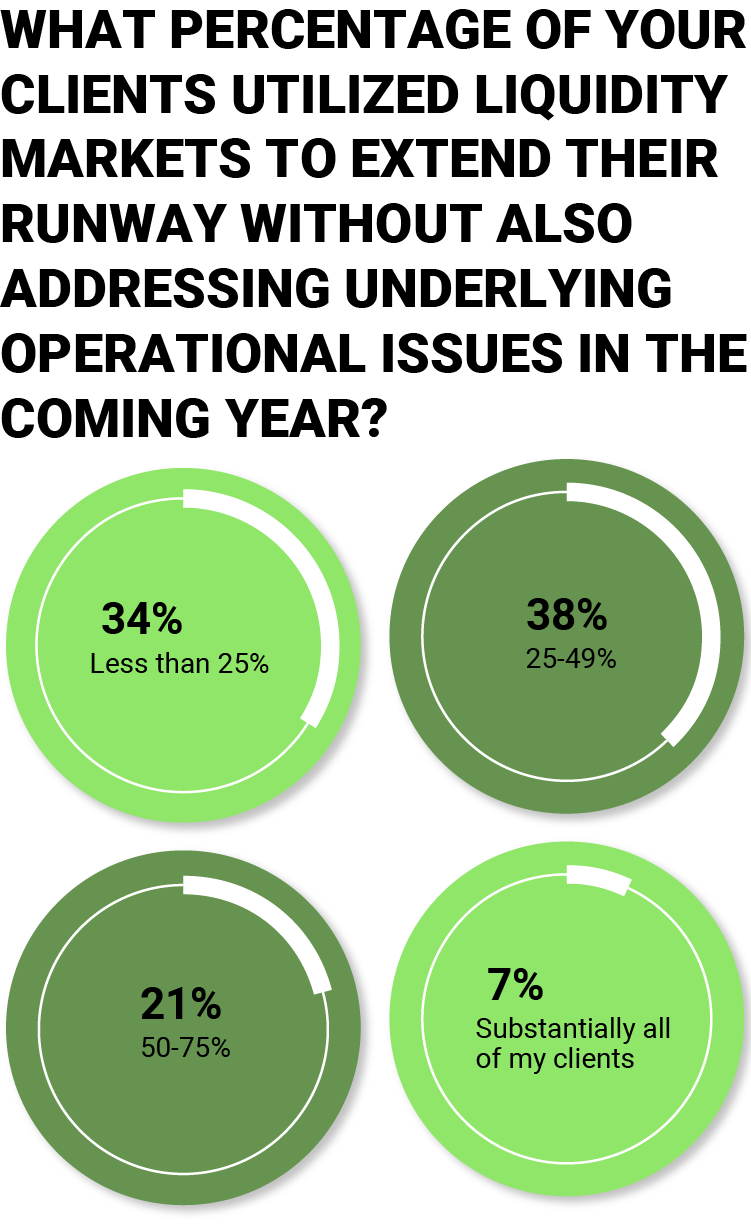

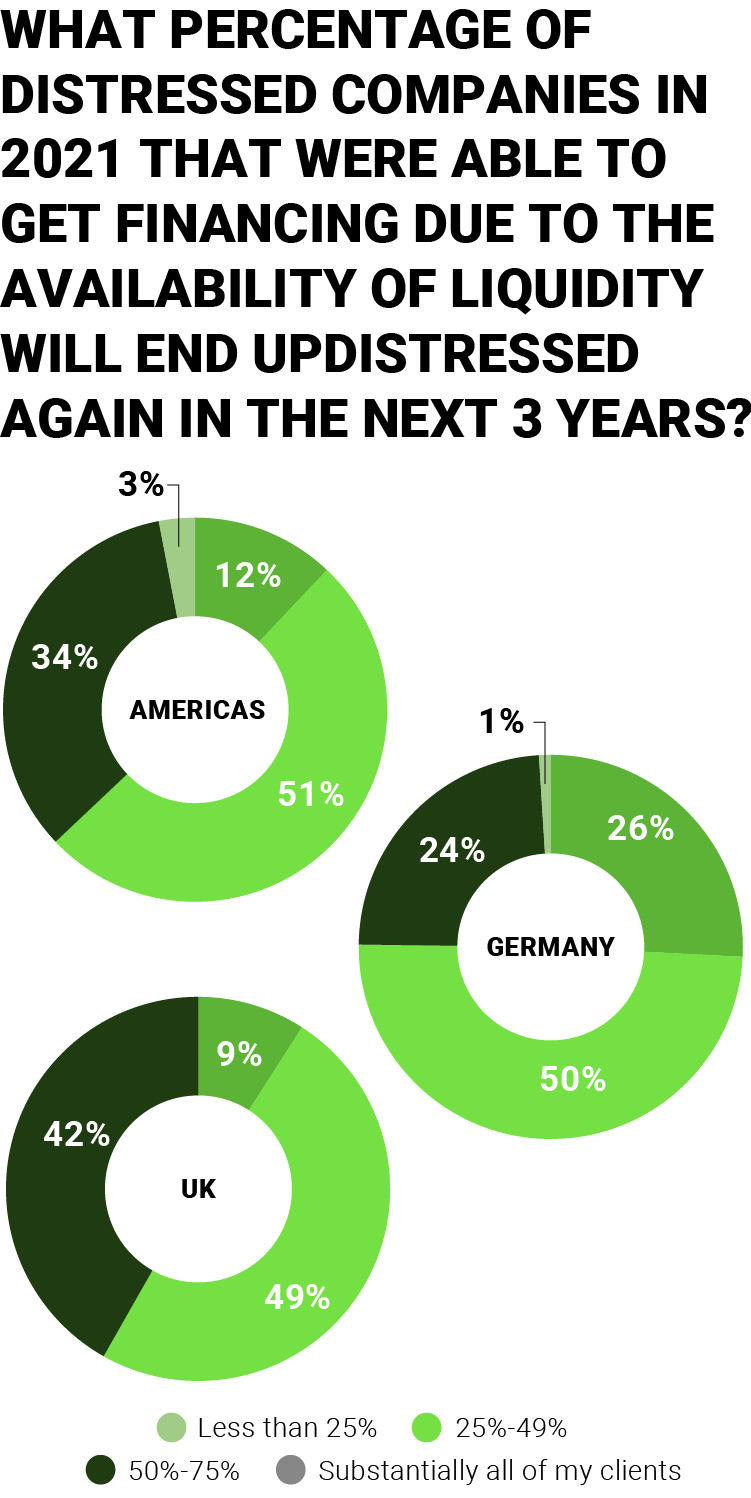

We find this troubling. While insolvency proceedings are part of “normal” economic life, there are undoubtedly companies that have used them to undertake running repairs on balance sheets without addressing the fundamental organizational issues that lie beneath. Restructure without reform often provides only temporary relief from distress – and survey respondents see as much in their practices. Globally, around one third expect the majority of distressed companies that secured financing in 2021 to lapse back into distress within three years. Respondents in the Americas and UK were particularly likely to foresee such a scenario.

We find this troubling. While insolvency proceedings are part of “normal” economic life, there are undoubtedly companies that have used them to undertake running repairs on balance sheets without addressing the fundamental organizational issues that lie beneath. Restructure without reform often provides only temporary relief from distress – and survey respondents see as much in their practices. Globally, around one third expect the majority of distressed companies that secured financing in 2021 to lapse back into distress within three years. Respondents in the Americas and UK were particularly likely to foresee such a scenario.

However, provided it is executed right the first time, insolvency should not be a dirty word. At its best, insolvency should allow a company to rise like a phoenix from the flames – instead of seeing value burn to ashes. Of course, tackling distress is easier said than done. Executives as familiar as any of us with the warning signs – overexpansion, excessive cost bases, poor cash management, siloed business planning and more – can nevertheless hesitate when they must move fast, despite the dangers of a “wait and see” strategy greatly heightened in such a furiously disruptive marketplace.

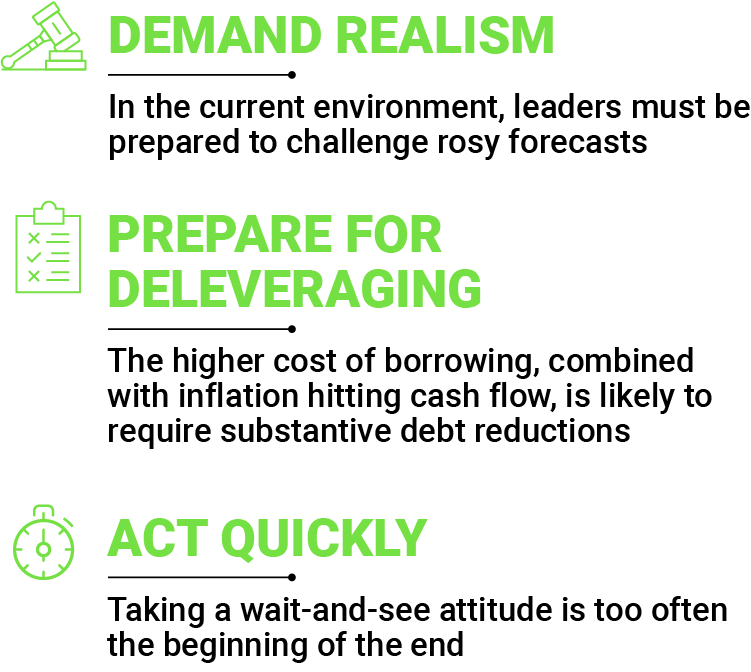

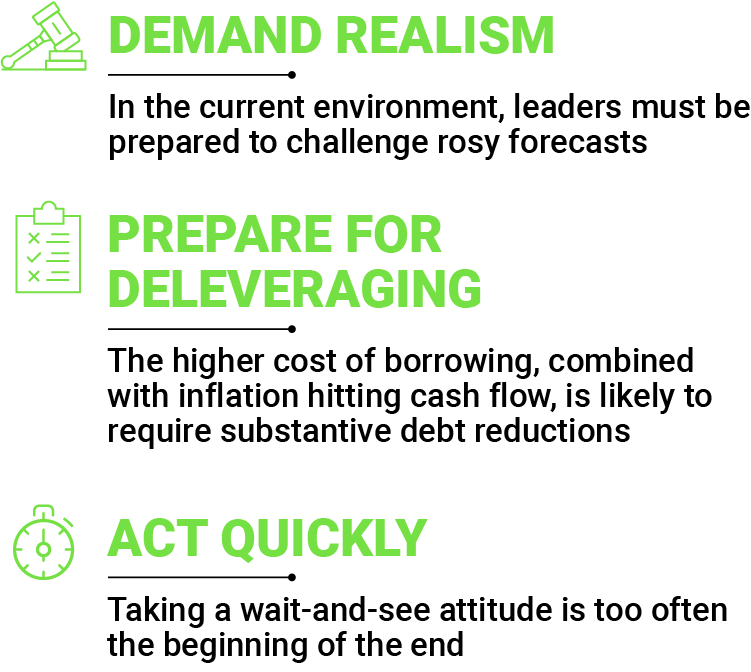

What should you take away from all this? First, demand realism. Some management teams – and indeed creditors – with less experience of navigating downturns may be prone to outbreaks of unwarranted optimism surrounding financial performance. In the current environment, leaders must be prepared to challenge rosy forecasts.

Second, prepare for deleveraging. The higher cost of borrowing, combined with inflation hitting cash flow, is likely to require substantive debt reductions where companies might once have simply refinanced.

Third, act quickly. A combined supply and demand crunch is not something that a company under financial pressure can hope to ride out. In this, we echo the point made in this year’s AlixPartners Disruption Index: Taking a wait-and-see attitude is too often the beginning of the end.