MERGERS & ACQUISITIONS

Put a premium on pace over playbooks

MERGERS & ACQUISITIONS

Put a premium on pace over playbooks

Dealmaking is different now.

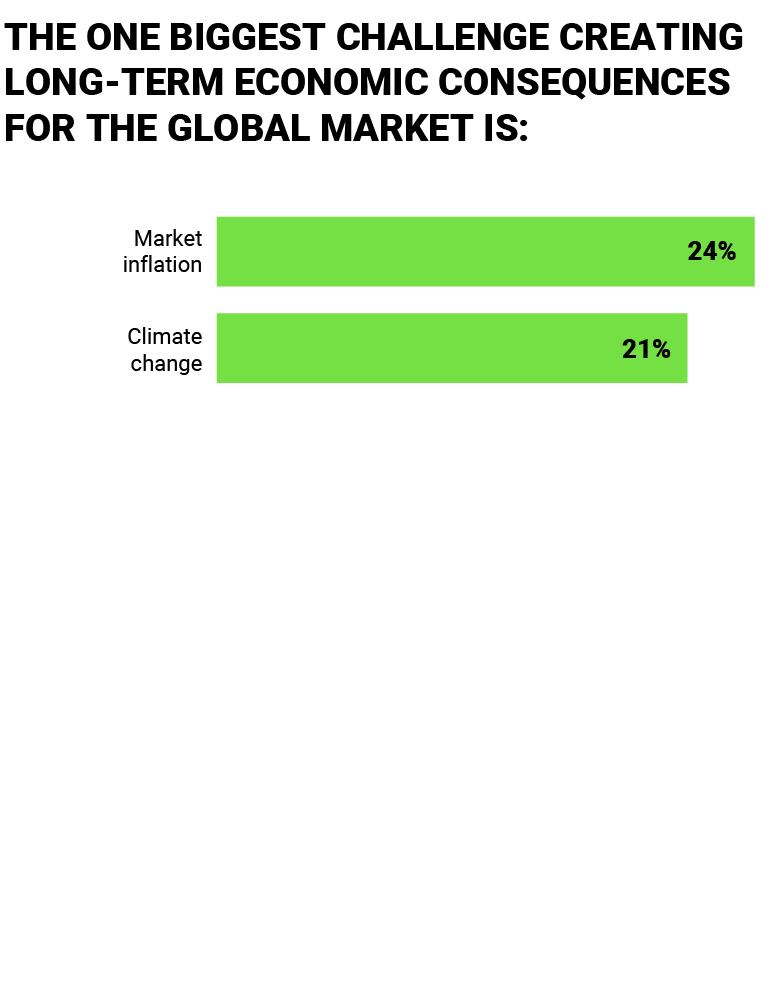

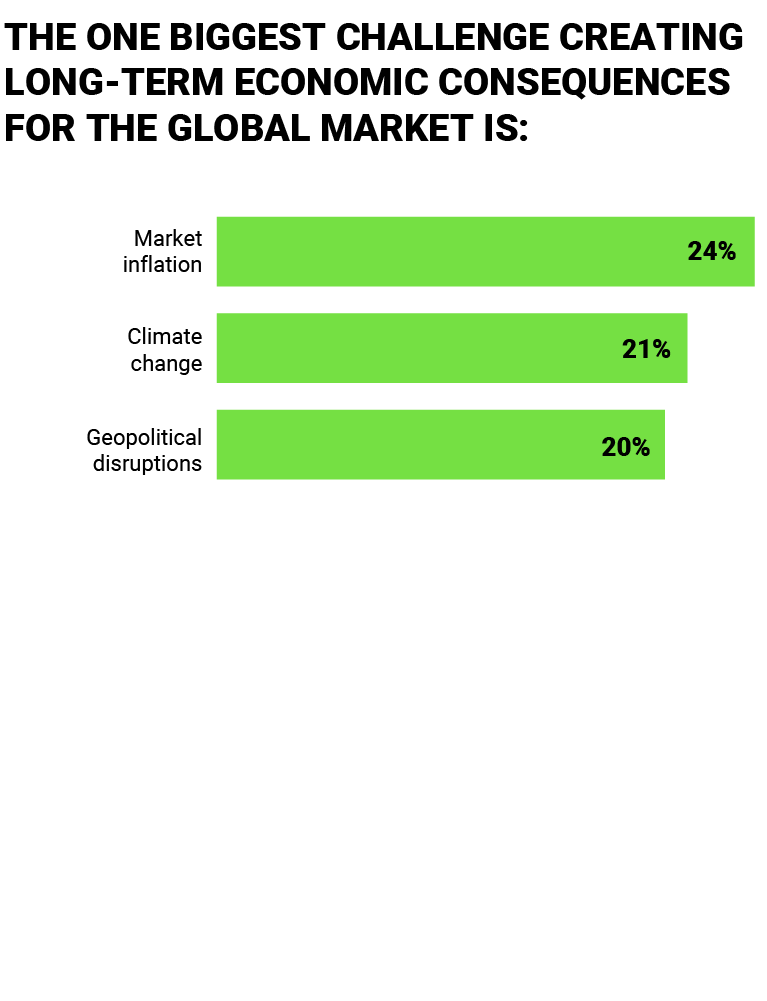

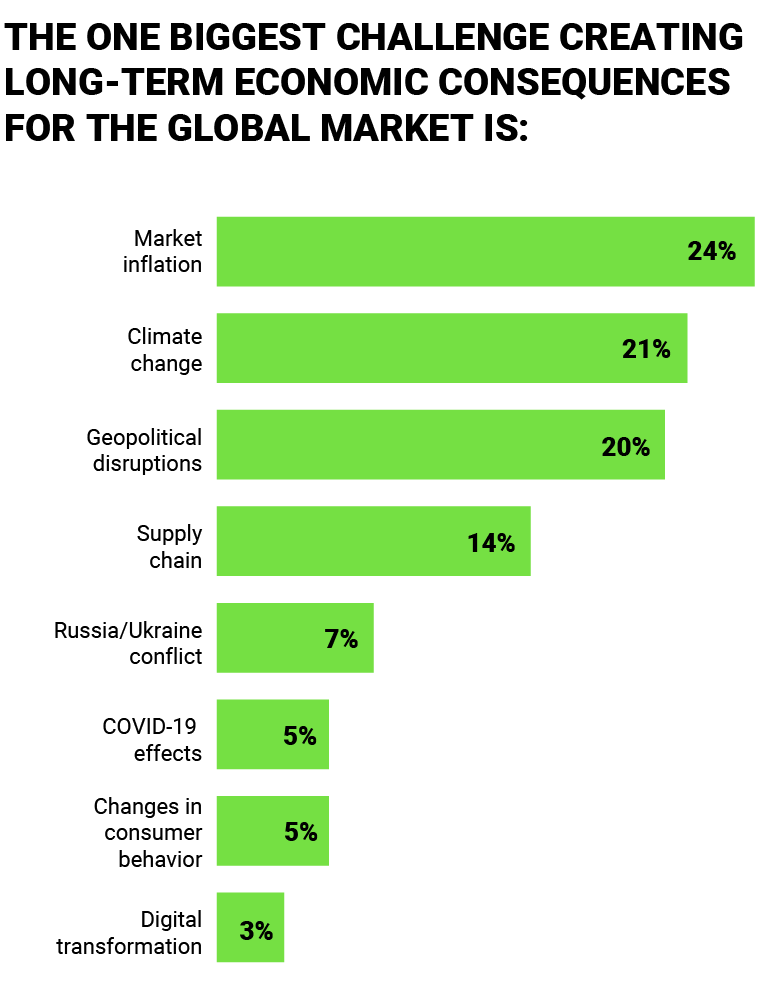

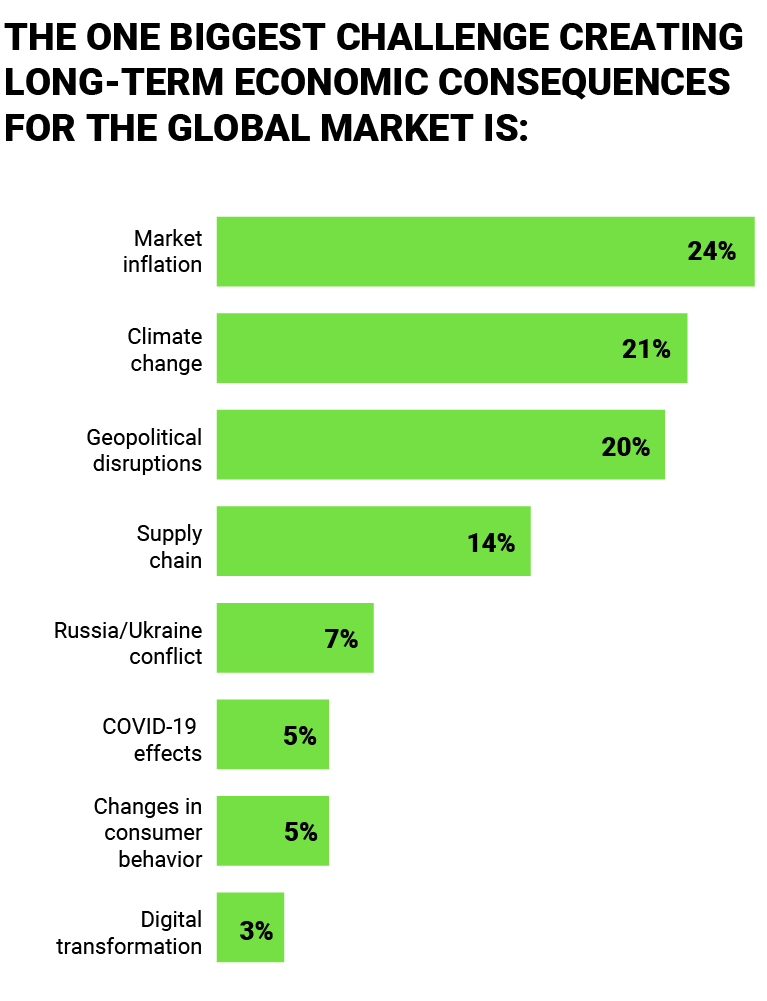

Expecting the unexpected has always been fundamental to M&A, as has the pressure to get strategic decisions right. However, with such profound technological, societal, and geopolitical shifts at play, the disruptive factors sitting outside of the traditional M&A playbook now present amplified challenges for transaction teams in any deal process.

The most agile teams will be nimble enough to shift their thinking to absorb new patterns and launch their next move knowing that another shock could be just around the corner. A more compartmentalized strategic approach is required, characterized by short bursts of planning and activity to help M&A teams ride the crest of each disruptive wave over a longer period.

Move at pace,

but avoid the underestimation trap

Opportunities must be seized and executed with the greatest possible speed.

Rapidly rising energy prices could wipe out hoped-for cost efficiencies, social issues could raise ESG-related concerns, and financing for deals could be curtailed – or pulled entirely – if changing market dynamics dent the attractiveness of a transaction for investors.

Companies must partner with experts who prioritize pace over playbooks to get the simple things done quickly, before focusing their experience toward dealing with the 20% of issues that often consume 80% of integration time.

A handful of scenarios tend to consume a disproportionate amount of time and effort – it’s not about processes, systems, or capacity constraints, but about achieving alignment on strategic topics born out of a very fluid macroeconomic environment.

The more conventional issues may relate to factors such as antitrust rules – buyers may know competition clearance is likely required, but regularly underestimate how long that process will take. More complex problems can arise when deals are scrutinized through an increasingly dominant ESG lens. In previous years, the decision about where two merging firms might consolidate their production facilities would be almost exclusively driven by cost. However, now we’re more frequently witnessing other issues influence these decisions, including the cost of transportation, the emission intensity of individual facilities, political uncertainty, and concerns about exploitation within supply chains. These factors and where they fit in the calculus is a growing challenge for management teams.

Opportunities must be seized and executed with the greatest possible speed.

Rapidly rising energy prices could wipe out hoped-for cost efficiencies, social issues could raise ESG-related concerns, and financing for deals could be curtailed – or pulled entirely – if changing market dynamics dent the attractiveness of a transaction for investors.

Companies must partner with experts who prioritize pace over playbooks to get the simple things done quickly, before focusing their experience toward dealing with the 20% of issues that often consume 80% of integration time.

A handful of scenarios tend to consume a disproportionate amount of time and effort – it’s not about processes, systems, or capacity constraints, but about achieving alignment on strategic topics born out of a very fluid macroeconomic environment.

The more conventional issues may relate to factors such as antitrust rules – buyers may know competition clearance is likely required, but regularly underestimate how long that process will take. More complex problems can arise when deals are scrutinized through an increasingly dominant ESG lens. In previous years, the decision about where two merging firms might consolidate their production facilities would be almost exclusively driven by cost. However, now we’re more frequently witnessing other issues influence these decisions, including the cost of transportation, the emission intensity of individual facilities, political uncertainty, and concerns about exploitation within supply chains. These factors and where they fit in the calculus is a growing challenge for management teams.

Deal hypotheses must stretch beyond the bottom line

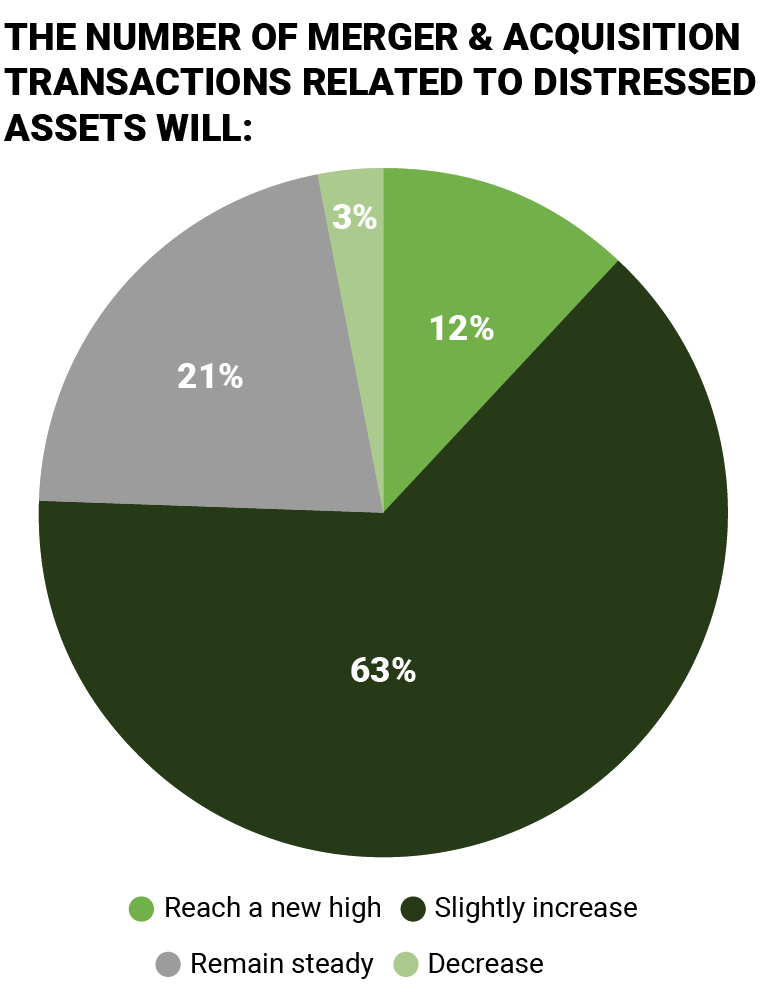

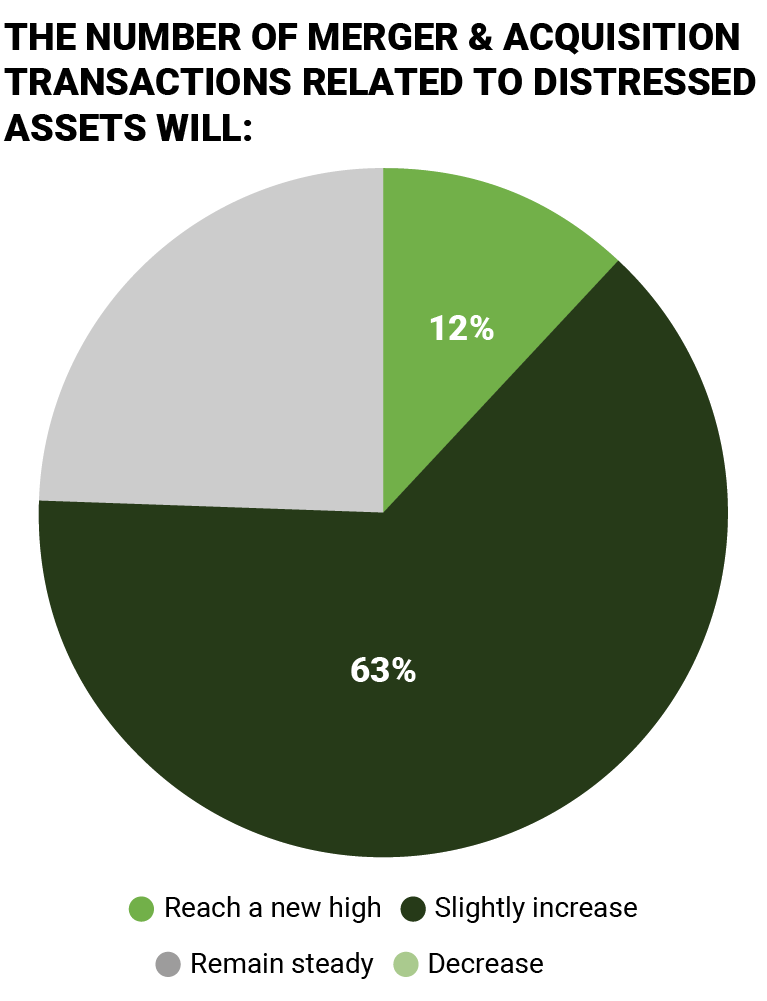

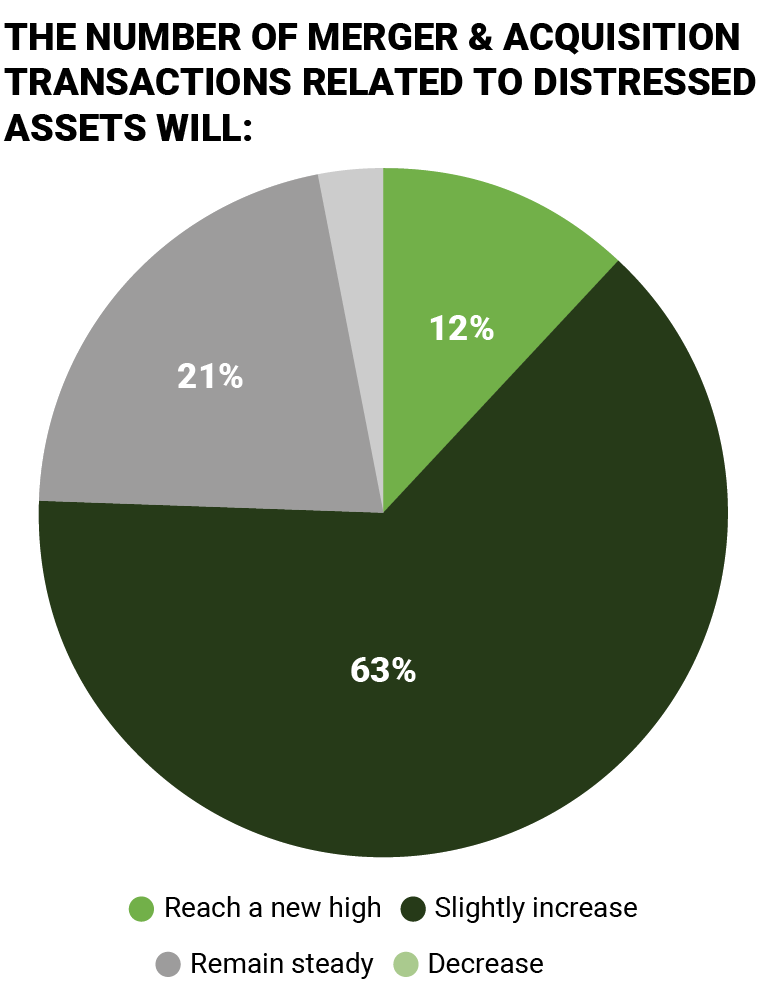

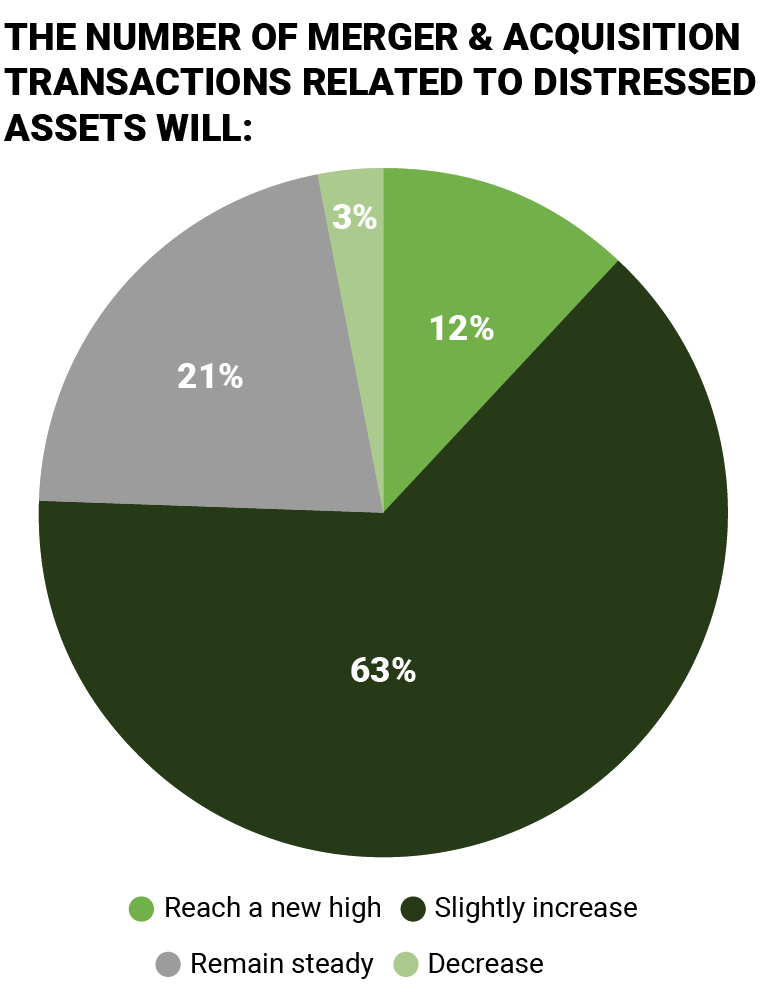

Our survey revealed that over 70% of firms believe that M&A transactions related to distressed assets will increase, including a sixth of respondents in Germany and more than one in 10 based in the UK expecting a new high.

It is therefore likely that business leaders will be forced to sell assets or reconsider investment in others to protect shareholder returns and generate greater liquidity. Not only will this lead to the use of operating model transformation to drive improved multiples internally, but it will also create opportunities for others to buy assets at potentially lower multiples. Due to the distressed nature of these assets, familiarity with alternative methods of buying and integrating corporate entities – such as Article 9 transfers in the US – will play an important role in navigating cost implications and complex capital structures.

All told, the bottom line of dealmaking is no longer simply about the bottom line. Today’s companies have a huge opportunity to create innovative, enduring business models through M&A that can be scaled globally, but it will be challenging.

Flexibility, agility, and speed of decision making will be hugely significant drivers of how transactions progress and the value that can be achieved. The importance of senior stakeholder alignment on critical strategic topics cannot be underestimated – issues such as operating models, go-to-market strategies, and investment priorities can quickly derail deals. Playbooks will not account for securing C-suite consensus on these topics. It is strategic experience that will come to the fore and allow teams to navigate these waters effectively as world events continue to evolve the landscape for future dealmaking.