ENVIRONMENTAL, SOCIAL AND GOVERNANCE

An alpha bet for big

business outcomes

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

An alpha bet for big business outcomes

In such an acutely scrutinous and digitally enabled era, corporate introspection and subsequent transformation at pace in relation to Environmental, Social, and Governance issues is critical. The rewards – stewardship, intrinsic and external value – can be significant for the businesses that can bring their purpose and values to the fore.

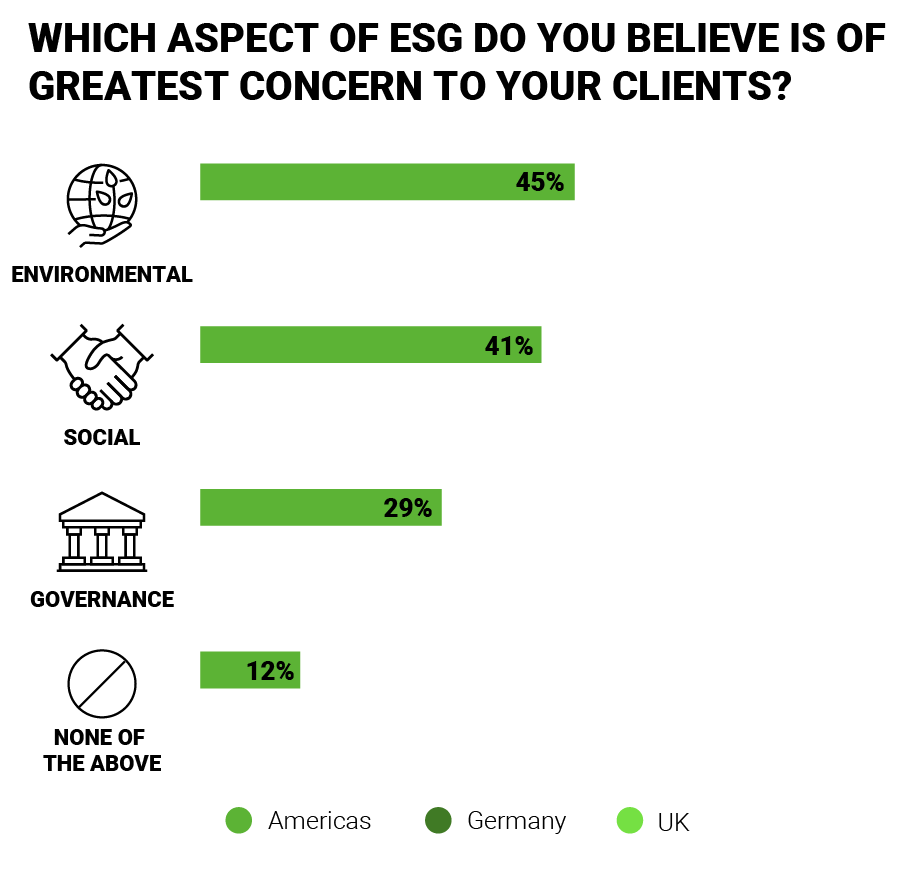

Our expert respondents revealed the importance that they believe firms must place upon ESG, with the vast majority linking progress here to financial viability and performance.

This demonstrates that the need for compliance should be a priority, given other vital interconnected business challenges such as supply chain logistics, client willingness to expand relationships, employee retention, and other critical areas necessary to grow businesses.

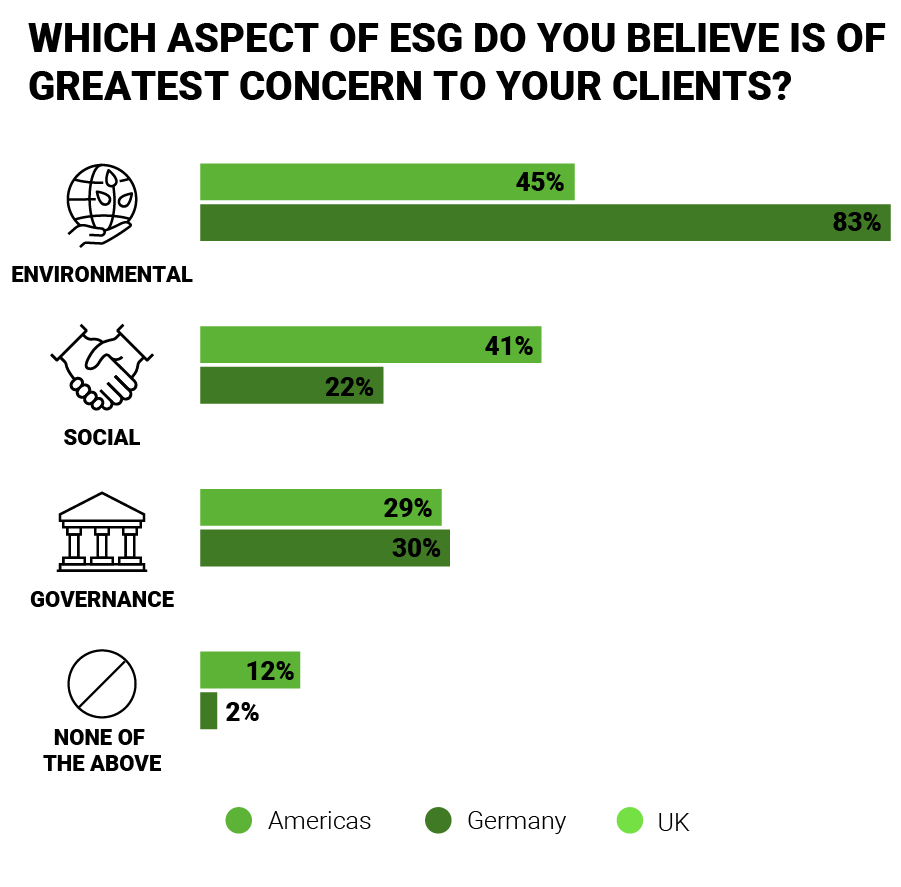

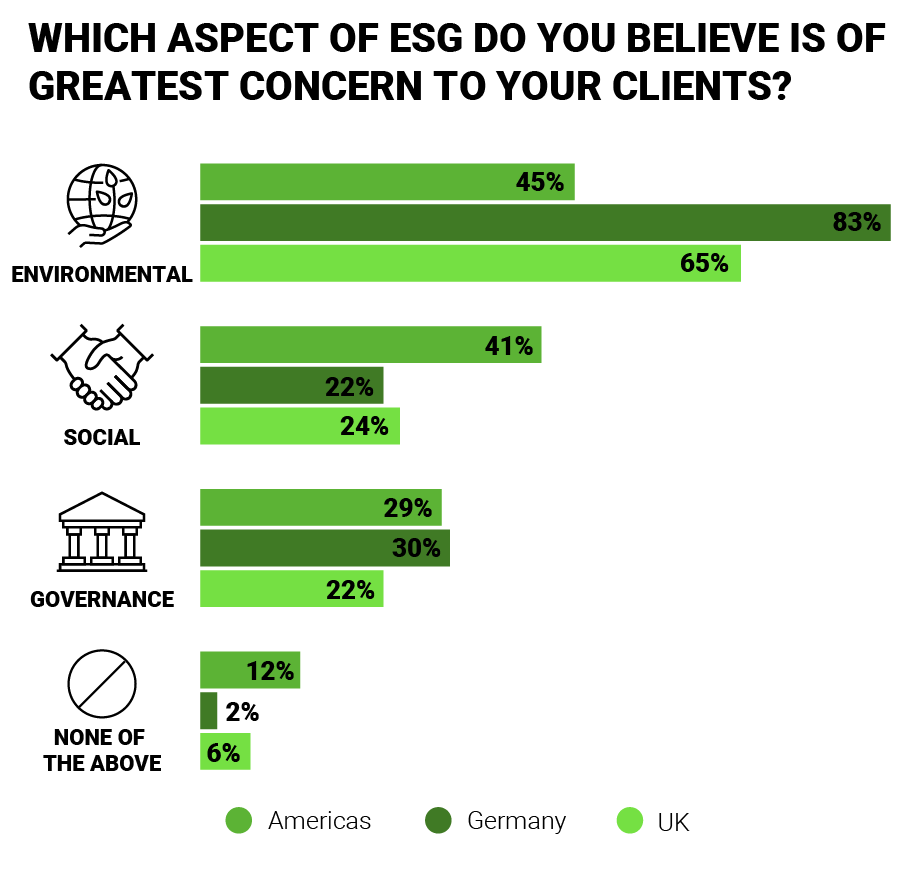

The ‘E’ component was also cited as being of most concern to restructuring experts and their clients, potentially demonstrating that they see this as the biggest hurdle to overcome. Nearly six in 10 respondents (58%) were most worried about tackling environmental issues in their organization, with 61% also believing this was their clients’ greatest fear.

While cutting emissions from production processes and supply chains will take time, there’s rapidly expanding regulatory pressure to at least explain how this will be done.

For example, in the UK, financial institutions and listed firms must publish plans in 2023 explaining how they hope to meet their Net Zero goals for 2050, and it’s likely that similar regulations will appear in more jurisdictions soon.

Effective planning is vital, compelling firms to measure their existing emissions, identifying where carbon reductions will come from, and highlighting assets or divisions that may need to be restructured or sold if the firm is to meet its climate goals.

Many lenders and investors are now completely avoiding carbon-intensive assets. Whereas some may have quietly backed this kind of asset in recent years, a growing number now deem it impossible rather than merely unpalatable.

But such firms can act. A clear plan for change is required, demonstrating how the company can either make its existing business less damaging to the environment, or outline how it will diversify its revenue streams.

Failure to do so could carry significant consequences. Our survey revealed that 69% of respondents either strongly agree or agree that a company’s ability to access finance will depend on complying with ESG guidelines.

Dealing with the ‘E’ in ESG undoubtedly has its challenges – particularly in relation to Scope 3 reduction. However, senior executives must also develop the right strategies that strike a careful balance across the ‘S’ and ‘G’ too, especially as macroeconomic events conspire to generate friction between the three intertwined components, raising the level of complexity in achieving compliance and maintaining momentum in implementing sustainable initiatives.

A comprehensive and enduring ESG compliance plan may prove the secret weapon in the war for talent, too. Companies with a clear purpose will be better positioned to attract and retain the very best people, as employees continue to correlate job satisfaction in a post-pandemic world with strong ESG ambitions and results – allied to a compelling values set – in addition to flexibility and work-life balance.

Prioritizing investment in ESG-related initiatives that can be measured and quantifiably demonstrate genuine progress will provide an immediate signal of real action being taken. Robust systems to identify evolving and emerging ESG risks are also critical, and will present business opportunities to harness if they are spotted early enough. Integrated into a rubric for developing residual risk calculations and controls, the transparent articulation of progress and performance can subsequently offer a competitive edge in communication with all stakeholder groups.

As the business world prepares to weather an economic downturn, it is imperative that management attention regarding ESG does not fall down the boardroom agenda. It is a long-term journey, but one that requires persistent focus and action every step of the way.

A comprehensive and enduring ESG compliance plan may prove the secret weapon in the war for talent, too. Companies with a clear purpose will be better positioned to attract and retain the very best people, as employees continue to correlate job satisfaction in a post-pandemic world with strong ESG ambitions and results – allied to a compelling values set – in addition to flexibility and work-life balance.

Prioritizing investment in ESG-related initiatives that can be measured and quantifiably demonstrate genuine progress will provide an immediate signal of real action being taken. Robust systems to identify evolving and emerging ESG risks are also critical, and will present business opportunities to harness if they are spotted early enough. Integrated into a rubric for developing residual risk calculations and controls, the transparent articulation of progress and performance can subsequently offer a competitive edge in communication with all stakeholder groups.

As the business world prepares to weather an economic downturn, it is imperative that management attention regarding ESG does not fall down the boardroom agenda. It is a long-term journey, but one that requires persistent focus and action every step of the way.