NET ZERO

Syncing ambition with outcomes across the CPG value chain

MAKING NET ZERO A REALITY ACROSS THE FOOD AND BEVERAGE INDUSTRY

The global food system is a massive and intricate network that supports lives and livelihoods everywhere in the world. But its complexity and size also lead to an enormous burden on the environment. Food and beverage companies are responsible for approximately one third of global greenhouse gas emissions. The industry, then, must make substantial changes if it is to achieve the Paris Agreement goal of limiting the increase in the globe’s temperature to 1.5 degrees Celsius. This task will be impossible without significant work that spans the industry – including a step change in collaboration along every step of the value chain.

THE PROGRESS WE’VE MADE

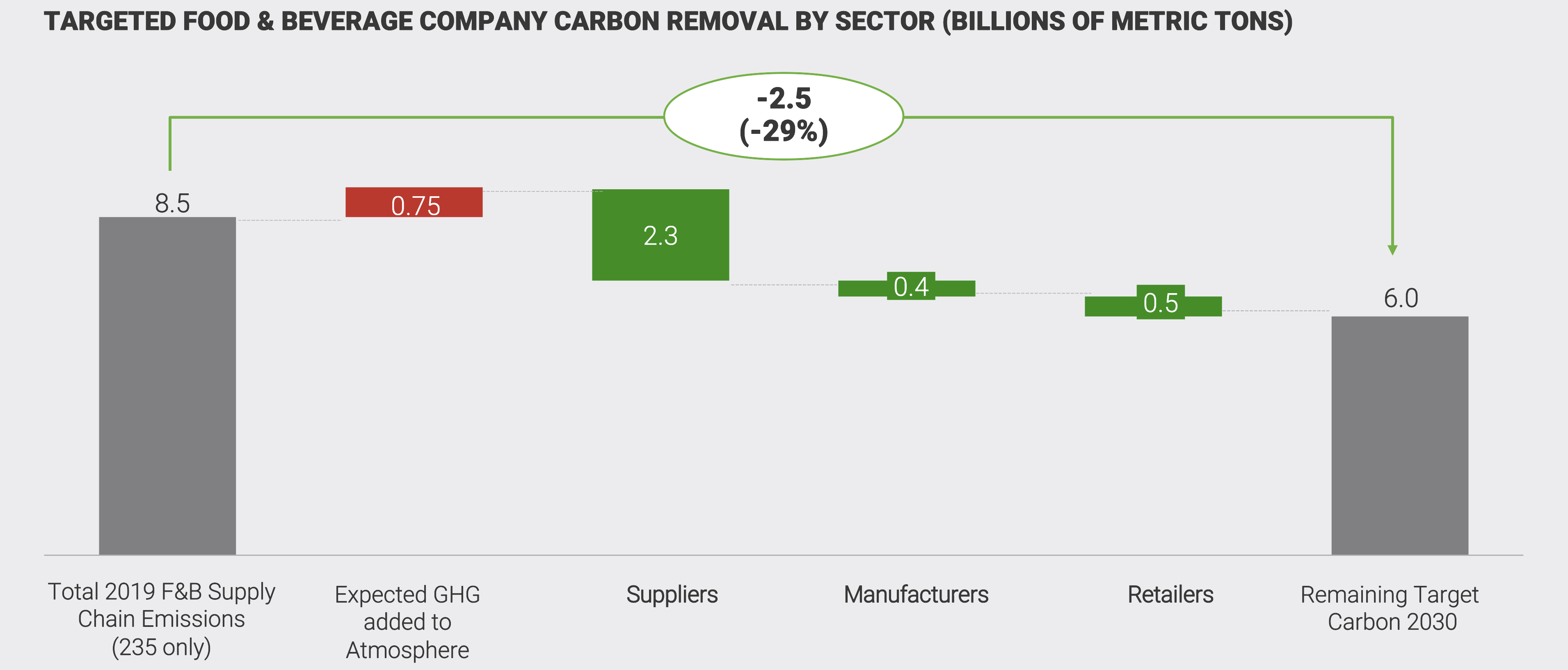

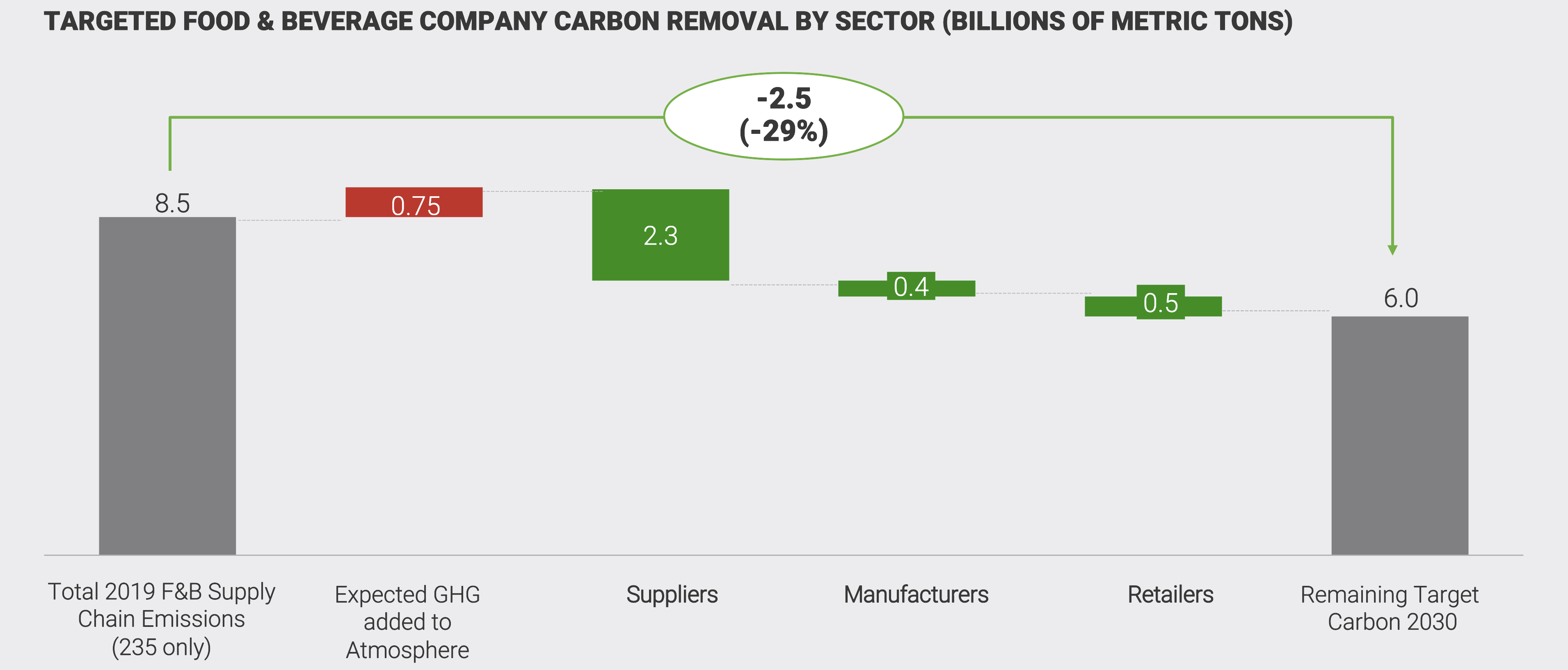

To determine the level of collaboration needed across the value chain for net zero to become a reality, AlixPartners conducted proprietary research into carbon reduction commitments made by 235 of the largest food and beverage companies in North America and EMEA. Companies came from all parts of the supply chain, including suppliers, manufacturers, and food retailers. We also reviewed financial indicators and conducted executive surveys with industry leaders to gain qualitative insight.

Nearly all companies among those we studied have set up programs with reduction commitments and targets. While there was only modest progress immediately following the Paris Agreement in 2015, many of the largest CPG companies were among the early movers and announced detailed plans as early as 2017 that committed them to reduce millions of metric tons of carbon emissions.

Continue reading to learn more or download the full report, here.

MAKING NET ZERO A REALITY ACROSS THE FOOD AND BEVERAGE INDUSTRY

The global food system is a massive and intricate network that supports lives and livelihoods everywhere in the world. But its complexity and size also lead to an enormous burden on the environment. Food and beverage companies are responsible for approximately one third of global greenhouse gas emissions. The industry, then, must make substantial changes if it is to achieve the Paris Agreement goal of limiting the increase in the globe’s temperature to 1.5 degrees Celsius. This task will be impossible without significant work that spans the industry – including a step change in collaboration along every step of the value chain.

THE PROGRESS WE’VE MADE

To determine the level of collaboration needed across the value chain for net zero to become a reality, AlixPartners conducted proprietary research into carbon reduction commitments made by 235 of the largest food and beverage companies in North America and EMEA. Companies came from all parts of the supply chain, including suppliers, manufacturers, and food retailers. We also reviewed financial indicators and conducted executive surveys with industry leaders to gain qualitative insight.

Nearly all companies among those we studied have set up programs with reduction commitments and targets. While there was only modest progress immediately following the Paris Agreement in 2015, many of the largest CPG companies were among the early movers and announced detailed plans as early as 2017 that committed them to reduce millions of metric tons of carbon emissions.

Continue reading to learn more or download the full report, here.

COMPANIES LACK CONFIDENCE IN MEETING CARBON GOALS, INDICATING SYSTEMIC ISSUES

Missing targets will have real financial consequences

Our research shows a dramatic gap in total shareholder return and a distinct gap in EBITDA growth between top and bottom performers on environmental, social, and governance goals over the long term.

Moreover, capital is more expensive for companies that do not perform on ESG matters. According to Dow Jones Sustainability Scores, debt on average costs lowest ESG performers more than double than it does top ESG performers. Sustainable investments, meanwhile, continue to see a flood of funding. More than $1,434 billion was dedicated to sustainable equity funds last year, more than twice the 2019 figure.

Retailers in particular lack confidence and feel an absence of control over their supplier emissions, indicating systemic issues that will demand a fulsome solution with unprecedented levels of collaboration across trading partners.

This lack of confidence can be attributed in part to the complexity of measuring carbon emissions up and down the supply chain. A lack of standardization in measuring and often even talking about sustainability contributes to this complexity, making it hard for companies to navigate current demands, let alone accelerate reduction. Another significant hurdle is that while suppliers and manufacturers are responsible for the most carbon, they do not believe they will be well compensated for reducing it by their upstream customers. Specifically, retailers are highly confident that consumers will pay, manufacturers are somewhat confident retailers will pay, and suppliers are least confident that manufacturers will pay more for sustainably produced inputs.

When confidence intervals for each value chain level are layered over carbon targets, even the 29% anticipated reduction by 2030 starts to look tenuous.

In percentage terms: requirements made to abide by the Paris Agreement demand a 37.6% reduction; current commitments only add up to 29% reduction; and when the lack of confidence in achieving targets is accounted for, it only results in a 25% reduction.

Our research shows a dramatic gap in total shareholder return and a distinct gap in EBITDA growth between top and bottom performers on environmental, social, and governance goals over the long term.

Moreover, capital is more expensive for companies that do not perform on ESG matters. According to Dow Jones Sustainability Scores, debt on average costs lowest ESG performers more than double than it does top ESG performers. Sustainable investments, meanwhile, continue to see a flood of funding. More than $1,434 billion was dedicated to sustainable equity funds last year, more than twice the 2019 figure.

Retailers in particular lack confidence and feel an absence of control over their supplier emissions, indicating systemic issues that will demand a fulsome solution with unprecedented levels of collaboration across trading partners.

This lack of confidence can be attributed in part to the complexity of measuring carbon emissions up and down the supply chain. A lack of standardization in measuring and often even talking about sustainability contributes to this complexity, making it hard for companies to navigate current demands, let alone accelerate reduction. Another significant hurdle is that while suppliers and manufacturers are responsible for the most carbon, they do not believe they will be well compensated for reducing it by their upstream customers. Specifically, retailers are highly confident that consumers will pay, manufacturers are somewhat confident retailers will pay, and suppliers are least confident that manufacturers will pay more for sustainably produced inputs.

When confidence intervals for each value chain level are layered over carbon targets, even the 29% anticipated reduction by 2030 starts to look tenuous.

In percentage terms: requirements made to abide by the Paris Agreement demand a 37.6% reduction; current commitments only add up to 29% reduction; and when the lack of confidence in achieving targets is accounted for, it only results in a 25% reduction.

COMPANIES NEED TO TAKE BOLD STEPS

Results will only be achieved when an organization actively engages its entire value chain

At this point, it’s obvious to ask what companies can do. At an operational level, the work required to achieve sustainability goals is not dissimilar to quality and cost improvements, which have now become business as usual and are typically aligned to key performance indicators and a firm’s overall strategy. We recommend three areas upon which to focus:

“Looking back, we talked to suppliers too late. If I had to do this again, I would engage suppliers more strongly and much earlier...even having a humble conversation is a helpful starting point.”

“Looking back, we talked to suppliers too late. If I had to do this again, I would engage suppliers more strongly and much earlier...even having a humble conversation is a helpful starting point.”

Results will only be achieved when an organization actively engages its entire value chain

At this point, it’s obvious to ask what companies can do. At an operational level, the work required to achieve sustainability goals is not dissimilar to quality and cost improvements, which have now become business as usual and are typically aligned to key performance indicators and a firm’s overall strategy. We recommend three areas upon which to focus:

Talk your suppliers’ and customers' language. Understand their interests, motivations, and needs for change.

- Think beyond your company boundaries

- Bring your suppliers and customers with you

- Learn and grow from experience

Strengthening your core capabilities will make emerging technology more effective when it arrives.

- Disconnect the here and now from future possibilities

- Determine who needs to act now

- Transfer the "doing" to operational teams

- Empower and enable the operating teams to deliver

Don’t let perfect be the enemy of good.

- Don’t overstudy the problem

- Get going in operations while innovating

- Adopt agile, fail‑fast mentality on unproven approaches

WE CAN HELP.

Cut complexity and improve the transparency of your route to Net Zero with Should-CarbonTM

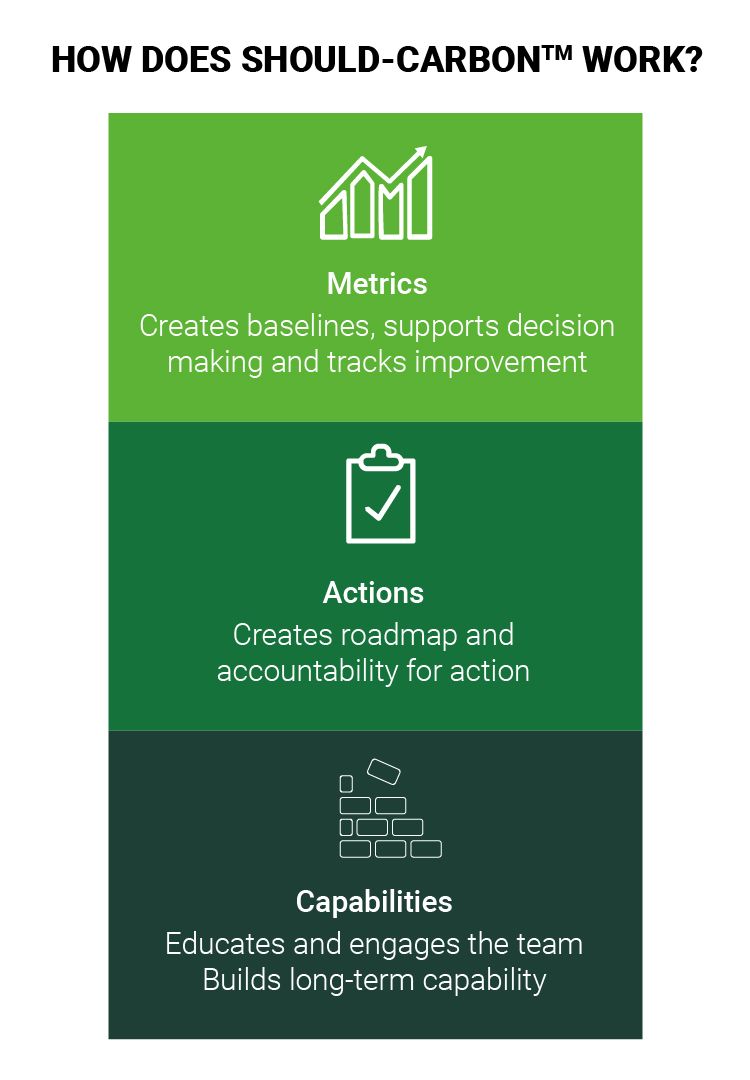

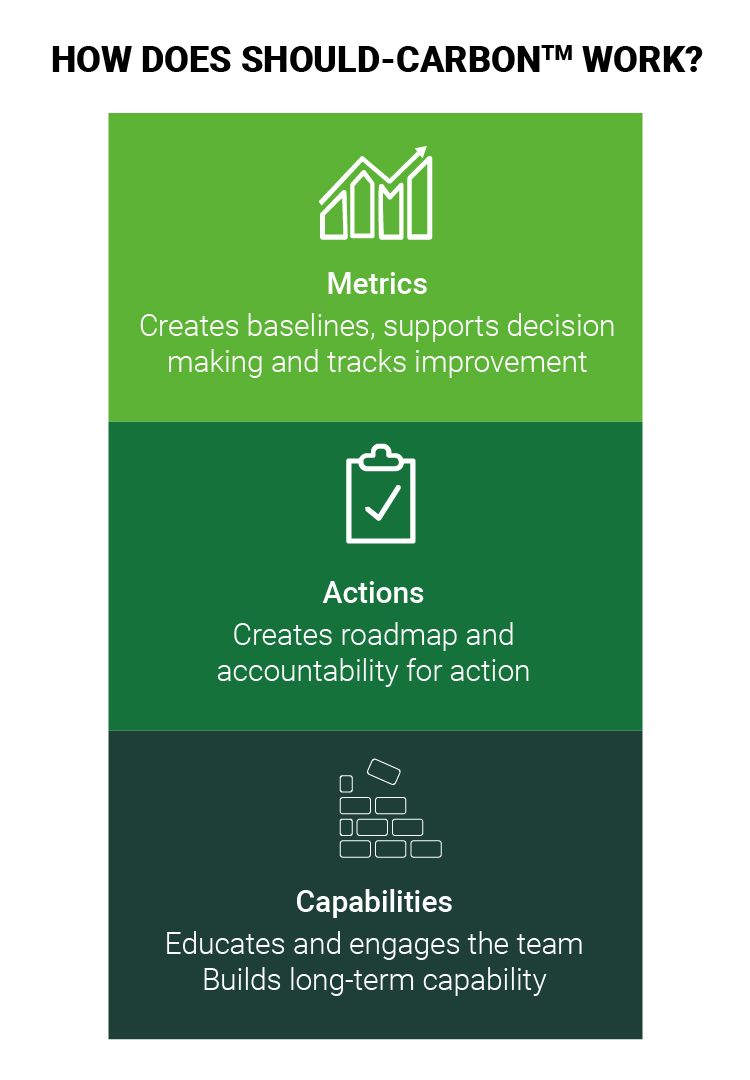

ACCELERATING THE JOURNEY TO SUPPLY CHAIN CARBON REDUCTION THROUGH METRICS, ACTION, AND CAPABILITY BUILDING

Not many would argue that reducing carbon emissions is a global imperative for every industry. But COP26 highlighted that companies are not on track to deliver net zero, and that a dramatic shift from strategic intent to action and results is necessary.

Successful carbon reduction requires expert management of a complex and dynamic stakeholder environment, both internally and across the value chain with trading partners.

AlixPartners’ Should-CarbonTM methodology and toolkit cuts through the complexity of calculating and actioning carbon reduction, making it easier to measure, map and, reduce supplier carbon at speed and scale.

Most organizations will have baselines and plans in place to improve their directly controllable scopes 1 and 2 emissions. However, the biggest challenge they face in effectively managing carbon reduction is in their supply chain – typically categorized as Scope 3 and driven by upstream suppliers.

Should-CarbonTM translates carbon measurement into actionable plans at each stage of category planning, procurement, and supplier management processes. This practical and pragmatic approach accelerates cross-business decision-making to mobilize, speed up, and scale carbon reduction initiatives across the supplier base.

The road to decarbonization is challenging, involves detailed operational thinking, and commitment to new ways of working. Now is the time to accelerate your journey to Net Zero with Should-CarbonTM.

ACCELERATING THE JOURNEY TO SUPPLY CHAIN CARBON REDUCTION

Not many would argue that reducing carbon emissions is a global imperative for every industry. But COP26 highlighted that companies are not on track to deliver net zero, and that a dramatic shift from strategic intent to action and results is necessary.

Successful carbon reduction requires expert management of a complex and dynamic stakeholder environment, both internally and across the value chain with trading partners.

AlixPartners’ Should-CarbonTM methodology and toolkit cuts through the complexity of calculating and actioning carbon reduction, making it easier to measure, map and, reduce supplier carbon at speed and scale.

Most organizations will have baselines and plans in place to improve their directly controllable scopes 1 and 2 emissions. However, the biggest challenge they face in effectively managing carbon reduction is in their supply chain – typically categorized as Scope 3 and driven by upstream suppliers.

Should-CarbonTM translates carbon measurement into actionable plans at each stage of category planning, procurement, and supplier management processes. This practical and pragmatic approach accelerates cross-business decision-making to mobilize, speed up, and scale carbon reduction initiatives across the supplier base.

The road to decarbonization is challenging, involves detailed operational thinking, and commitment to new ways of working. Now is the time to accelerate your journey to Net Zero with Should-CarbonTM.