MAXIMIZING VALUE CREATION DURING TIMES OF UNCERTAINTY

MAXIMIZING VALUE CREATION DURING TIMES OF UNCERTAINTY

How can PE firms and portfolio companies (portcos) navigate the way to value creation in today’s stormy business environment? Disruptive forces, structural changes in the industry, and high interest rates have collided to make value creation more urgent—and more difficult—at every stage of the PE investment cycle.

What are the new routes to value? What are the new instruments and tools? How can PE firms and portcos use them well? In this article series, AlixPartners experts outline these new routes, instruments, and tools, and show how to put them to work.

SIGN TO CLOSE

The time between the signing and closing of an M&A deal is lengthening—by quite some distance. Investors and management teams have long focused on the pre-signing due diligence phase, and the post-close first-100 days; but the growing interval between them can endanger the realization of deal value.

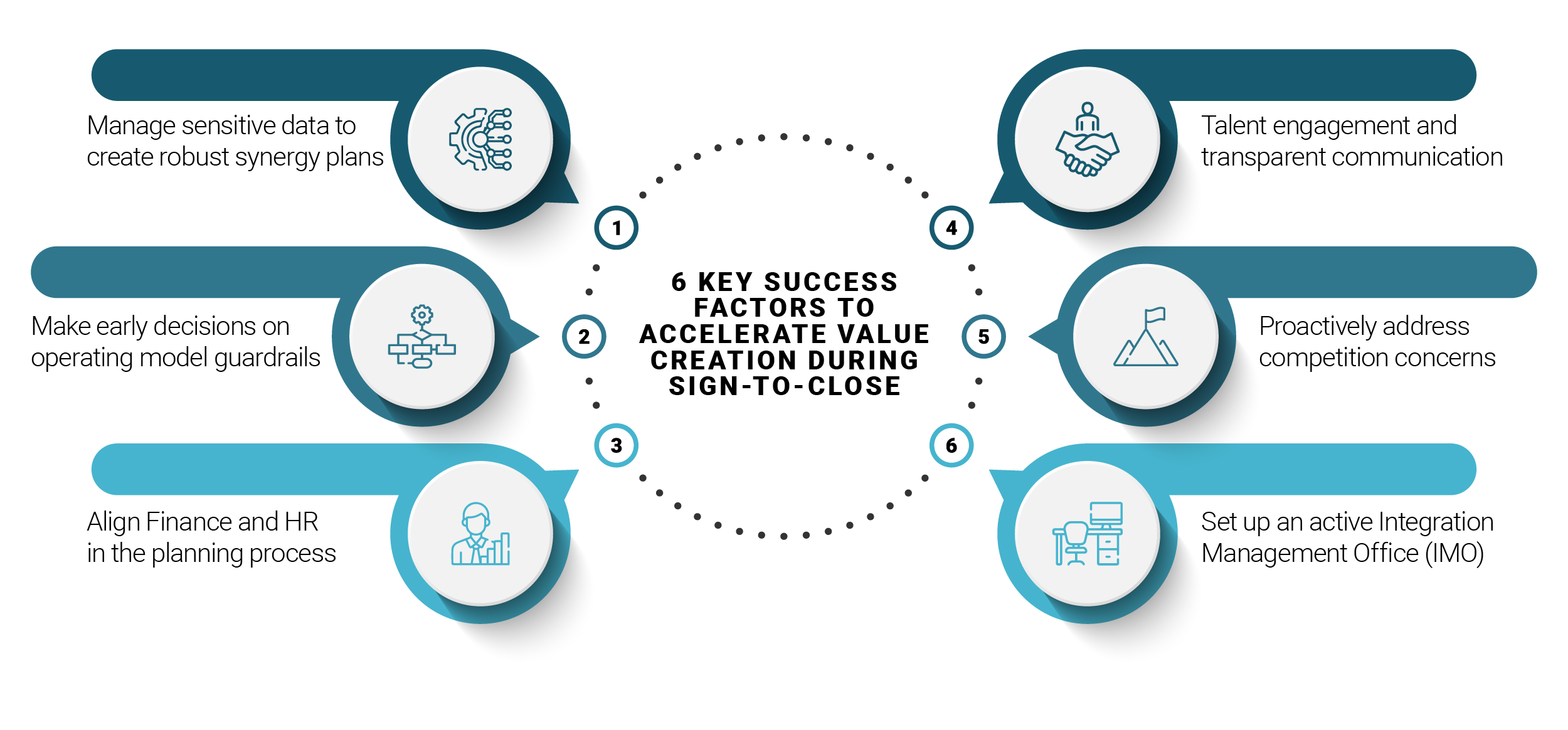

SUCCESS FACTORS FOR ACCELERATED VALUE CREATION DURING SIGN TO CLOSE PERIODS

Taking this approach, AlixPartners has developed tools and approaches that better leverage the period prior to regulatory close as a critical part of the integration lifecycle.

“We worked with AlixPartners through a highly complex regulatory period during our acquisition of Waterlogic Group in 2022. Their rigorous approach to working with both parties immediately post signing and through to close enabled our teams to develop a highly robust business case—with buy-in from all stakeholders—that ultimately helped us accelerate the delivery of our deal thesis post-close.”

WANT TO LEARN MORE?

MID-INVESTMENT

In the past 10 years, the average buyout fund has consistently outperformed the S&P 500—by a significant margin across multiple time periods and geographies. Not surprisingly, money has followed success. In 2022, private equity (PE) firms raised a record $938 billion; today, they have about $2.5 trillion waiting to be deployed.

WANT TO LEARN MORE?

WHEN THE END IS IN SIGHT

In the private equity world, finding an attractive asset, acquiring it at the right price, and successfully executing a value creation plan post-acquisition are all critical components to success, but the true test comes in realizing the value and returns upon exit. The current market has become increasingly difficult for successfully exiting investments and realizing internal rate-of-return targets—let alone exceeding them.

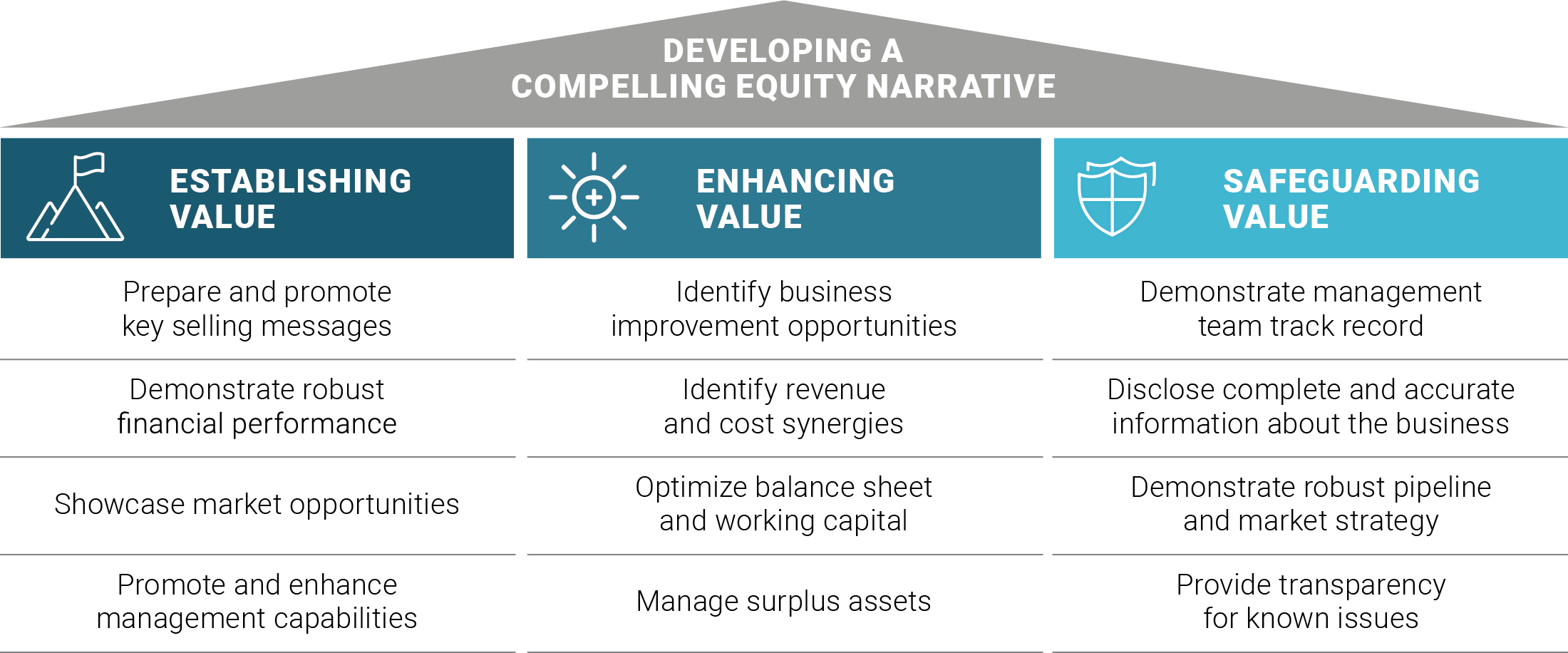

THREE KEY PILLARS FOR DEVELOPING A COMPELLING EQUITY NARRATIVE

Sellers must develop a logical and attractive equity narrative that explains why the asset can create more value under new ownership and management. The narrative should align to the long-term strategy followed throughout the ownership period and is complimented by concrete, actionable value creation levers that a new owner can execute from day one.

WANT TO LEARN MORE?

MEET THE TEAM

Want to continue the conversation?

Connect with our experts

The pace at which disruption is forcing change is truly unprecedented.

Is your business prepared?

Sign up to receive insights like this in your inbox.