Stephen Yu

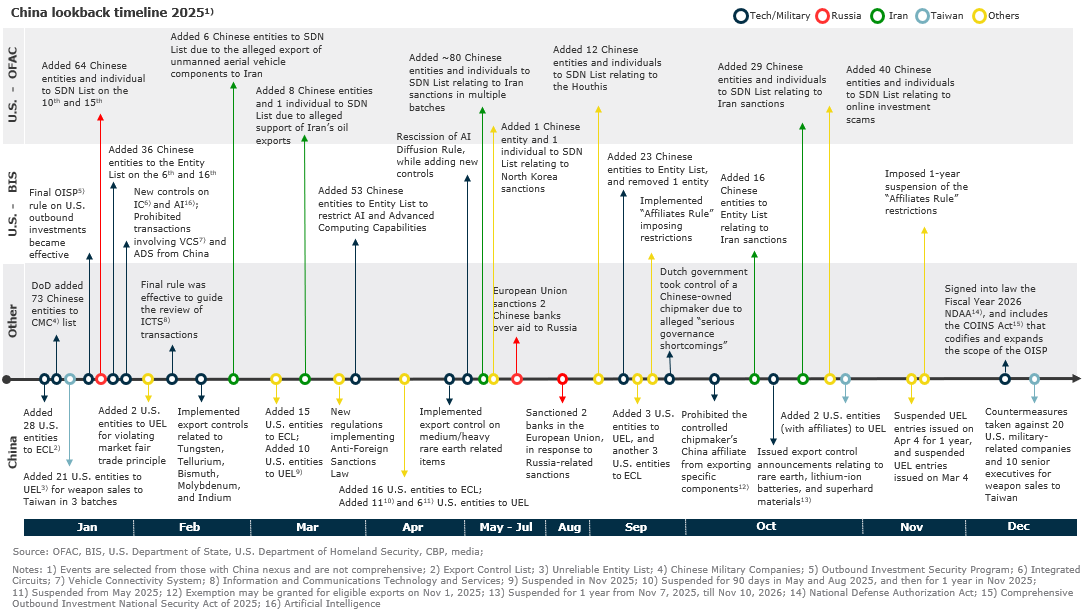

In early 2025, the United States introduced several new trade and outbound investment measures related to China. However, some of these measures were later adjusted or partially suspended following negotiations. During the same period, China expanded its export controls on rare earth materials, including extraterritorial rules, while it more frequently used its Export Control List (“ECL”) and Unreliable Entity List (“UEL”) to designate foreign entities.

FIGURE 1: CHINA LOOKBACK TIMELINE 2025

The following are some key takeaways from 2025:

Expanded US restrictions on ICTS and outbound investment. The Securing the Information and Communications Technology and Services Supply Chain regulations (the “ICTS rule”) under Executive Order 13873 took effect in February 2025, establishing a framework to review ICTS transactions involving critical infrastructure, sensitive personal data, and critical or emerging technologies. Relying on the same authority, the Bureau of Industry and Security (“BIS”) issued a January 2025 final rule restricting the sale or import of certain Vehicle Connectivity System (“VCS”) and Automated Driving System (“ADS”) software supplied by “persons with a sufficient nexus to the PRC or Russia.” Also in January 2025, the U.S. Treasury’s Outbound Investment Security Program (“OISP”) took effect, establishing a standing screening regime for U.S. investments in Chinese‑owned companies in three sectors: semiconductors and microelectronics, quantum information technologies, and artificial intelligence. In December 2025, the Comprehensive Outbound Investment National Security Act of 2025 (“COINS Act”) was signed into law, further expanding the scope of OISP.

Affiliate Rule announced by BIS and later suspended. In September 2025, BIS announced an “Affiliates Rule”, expanding controls to 50%-owned affiliates of certain listed entities. However, this rule was subsequently suspended for one year, starting from November 2025. This creates a high level of uncertainty in the broader industry. By the end of 2025, the Entity List had expanded to include more than 1,000 Chinese individuals and entities, with the addition of more than 120 new entries.

Chinese companies continued to be designated due to alleged support of sanctions and export‑control evasion involving Russia, Iran, and North Korea. Throughout 2025, more than 230 Chinese individuals and organizations were designated under OFAC’s Russia-, Iran-, and North Korea-related sanctions programs, alongside more than 15 additions to the Entity List for their alleged role in diverting controlled U.S.-origin goods to those regions. The U.S.-China Economic and Security Review Commission issued a report in November 2025, signaling the attention of U.S. regulators in this area.

The Chinese Government expanded its controls on rare earths and continued the designation of foreign parties. In February 2025, China restricted exports of five critical metals. In April 2025, China tightened license requirements for rare-earth exports. In October, the Ministry of Commerce (“MOFCOM”) issued a package of measures that significantly broadened related export controls to cover a wider range of rare-earth metals, permanent magnets, as well as the related products, technologies, and services. Notably, MOFCOM Notice No. 61 created a Chinese version of a “50% rule”, providing that license applications involving importers or end‑users on China’s export control lists (including their subsidiaries and branches that are 50% or more owned by such listed entities) will, in principle, be denied. Part of those measures have been temporarily suspended following mutual understandings reached with the U.S. Government. Throughout 2025, China also added dozens of new foreign companies to the UEL and, through the Ministry of Foreign Affairs, announced direct sanctions measures against specific entities and individuals under China’s ECL.

Looking ahead, the repositioning of China in the U.S. National Security Strategy suggests a more calibrated and balanced approach to trade-related tools, including:

Potential reactivation of BIS “Affiliates Rule” after the one‑year suspension: Companies should use the suspension period to identify high‑risk relationships, map ownership structures, and prepare for the rule’s potential reactivation.

Greater scrutiny of Chinese traders and intermediaries: Enforcement is likely to continue to focus on circumvention risks, including trans‑shipment, layered ownership, and use of third‑country hubs to bypass export controls and sanctions.

Expanding ICTS rules and the outbound investment security program: U.S. regulators are expected to apply these frameworks more broadly to China‑linked ICTS, connected products, and sensitive outbound investments, tightening controls on technology, data, and capital flows.

While Chinese companies increasingly expand overseas, they are recommended to continually monitor changes in sanctions and trade restrictions and design their organizations and supply chains to remain adaptable and flexible. More broadly, it is essential that they strengthen overseas risk management and supply security as a strategic priority.

AlixPartners brings extensive expertise in helping clients develop compliance programs, respond to regulatory inquiries, support eDiscovery and fact-finding efforts, and serve as expert witnesses in litigation and arbitration matters arising from potential sanctions violations or interruptions. Please feel free to contact us with any questions regarding this article or our services.

This review is also available to explore below or download here.