FACING DOWN THE STORM

How some companies are turning disruption into opportunity

FACING DOWN THE STORM

How some companies are turning disruption into opportunity

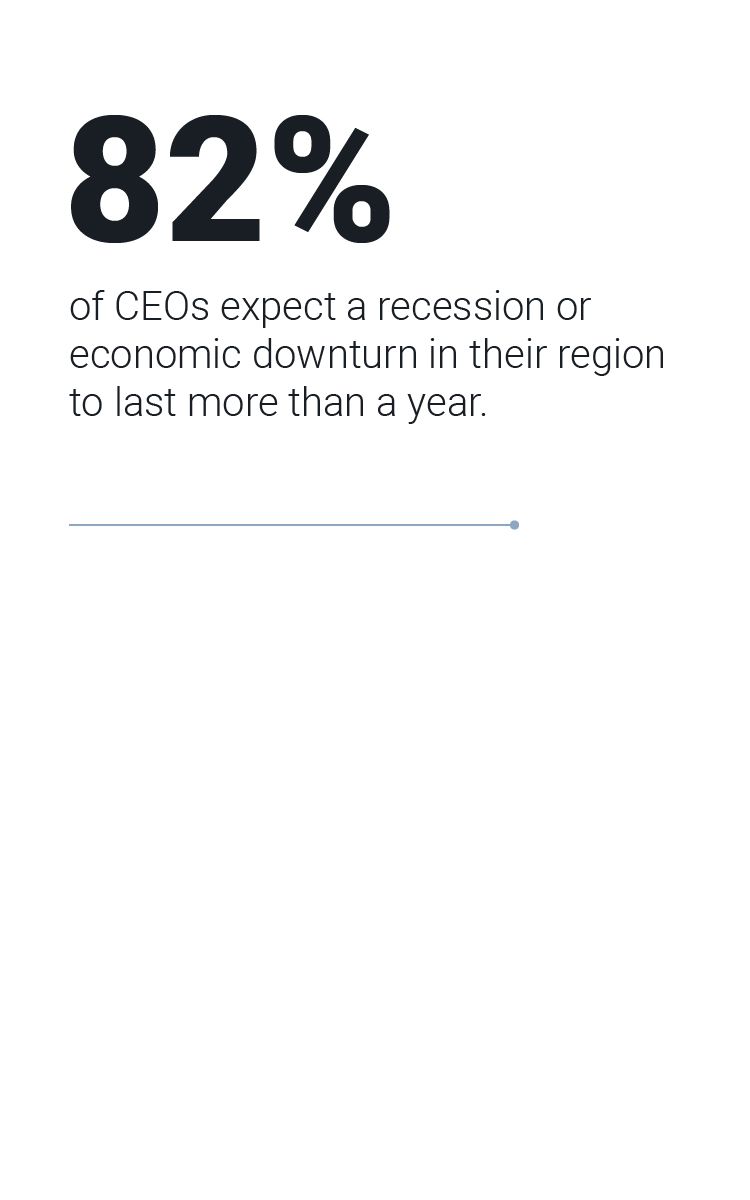

The economy has slowed. Many regions and industries are headed for a recession or at least a downturn—and 35% of executives surveyed by AlixPartners expect a down cycle that lasts three years or more. Inflation is high; interest rates are rising; bubbles are bursting. Uncertainty clouds everything.

SO WHAT ARE YOU DOING ABOUT IT?

Business-as-usual won’t cut it in unusual times. That’s especially true for technology companies, their leaders, and their investors, because when it comes to disruption, technology is both a driver and a passenger—the cause of change in their clients’ business, but also an industry that disrupts itself again and again. More than that: As recent stock market performance shows, tech companies are far from immune to the business cycle; indeed, when AlixPartners asked 3,000 executives how they feel about their company’s prospects in a recession, leaders of tech companies were more pessimistic than any industry group except retailers.

Whether they’re selling services, software, or hardware, technology companies must act quickly to protect value and to get in position to grow value rapidly when the economy turns back up or when an opportunity arises. In a recent Harvard Business Review article, Simon Freakley, CEO of AlixPartners, and Lisa Donahue, the firm’s co-head of North America and Asia, outlined a four-part approach to recession readiness: Tune up financial warning systems; maximize cash generation; use scenarios to discover and create options— scenarios; and act. We’ve developed some of the implications of this thinking—and action items—in workshops with technology companies.

"Budgeting-as-usual isn’t up to coping with this moment. Performative austerity—a nip here, a tuck there, and hope for the best—won’t be enough. The guidance it produces might even be dangerous. What’s needed now is action."

FOUR ACTIONS BUSINESS LEADERS CAN TAKE RIGHT NOW

Most companies see danger too late. One reason: business-unit budgets generally track revenues and costs—items on the income statement—but not cash flow or balance sheet items. The three get tied together at the highest level of the company, but it’s important for P&L owners to see them, too. They’re likely to be the first to spot softness in orders, growth in inventory, or delays in collections; but they’re less likely to realize the broad significance of what they see. They effectively ignore the cost of capital and rarely look to the balance sheet as a source of funds or savings. Redesign your planning and your monthly and quarterly reviews to reveal all three of the views of your business: the P&L, the balance sheet, and cash flow. Understand where your revenues are vulnerable and how those can be impacted with a sudden drop in demand. What costs are at risk? What assets will be impacted? What signs will warn you?

When times are tough (or just weird), cash is king. That’s doubly true when interest rates are rising. Therefore, build working-capital-management initiatives into your plans: projects to improve cash generation by changing how you manage payables and receivables, reducing inventory, speeding distribution, and so on. Get specific about how much will be saved by when and by whom, and actively monitor progress and the attendant cash generation. Add more to your cash by drawing down lines of credit. In addition, examine the assets on your balance sheet. Are you better off owning trucks or renting them? How many of IT assets have not yet migrated to the cloud? By outsourcing assets or processes, you can turn fixed costs into variable ones, which allows you to dial your need for cash up or down if conditions change.

When times are tough (or just weird), cash is king. That’s doubly true when interest rates are rising. Therefore, build working-capital-management initiatives into your plans: projects to improve cash generation by changing how you manage payables and receivables, reducing inventory, speeding distribution, and so on. Get specific about how much will be saved by when and by whom, and actively monitor progress and the attendant cash generation. Add more to your cash by drawing down lines of credit. In addition, examine the assets on your balance sheet. Are you better off owning trucks or renting them? How many of IT assets have not yet migrated to the cloud? By outsourcing assets or processes, you can turn fixed costs into variable ones, which allows you to dial your need for cash up or down if conditions change.

What would a mild, moderate, and severe downturn do to your business, and what parts would be hurt most? Where are you most vulnerable to inflation, a drop in consumer spending, a snarl in the supply chain? What actions would you take in each case? Who in your enterprise is best equipped to take those actions? Build out three scenarios and three responses—levers you can pull at a moment’s notice. First is the easy-to-pull lever: a set of actions that will conserve cash with no long-term damage, such as hiring and travel freezes, reductions in discretionary spending, cuts in some kinds of marketing spend. The second lever—which you will pull if a downturn is fairly deep or long—is more painful; these are steps like delaying new product launches or cutting capital spending except for maintenance. Finally, prepare a crisis playbook: the actions can you take if the business suddenly finds itself in deep trouble.

Prepare these scenarios now, when you don’t need them. That way, if business goes south the question becomes when to act, not what to do. You should also pre-set indicators of when each lever should be pulled; this will make it harder to ignore warnings. Then use monthly and quarterly reviews not just to track performance to plan, but to revalidate the premises you built the plan on. In a fast-moving environment, what was true six months ago might no longer be true. That doesn’t mean you were wrong; it means things changed.

Downturns drive shifts in competitive position and industry structure. Those who stay ahead create the most value on the rebound. Companies with strong financial warning systems and a strong cash position can see problems fast and defend against them. Companies with robust scenario plans in place can act fast to cut back (if that’s needed) or charge ahead (when that’s possible).

What won’t work is the same-old, same-old planning and budgeting process. You need to act fast and set targets quickly; avoid analysis paralysis; prioritize progress over perfection, and focus on the 80/20 rule; bring everyone into the process; and be ready to change your tactics and strategy as the market and the economy dictate.

As executives and managers prepare, they should ask themselves—and each other—twelve questions about recession readiness.

Downturns drive shifts in competitive position and industry structure. Those who stay ahead create the most value on the rebound. Companies with strong financial warning systems and a strong cash position can see problems fast and defend against them. Companies with robust scenario plans in place can act fast to cut back (if that’s needed) or charge ahead (when that’s possible).

What won’t work is the same-old, same-old planning and budgeting process. You need to act fast and set targets quickly; avoid analysis paralysis; prioritize progress over perfection, and focus on the 80/20 rule; bring everyone into the process; and be ready to change your tactics and strategy as the market and the economy dictate.

As executives and managers prepare, they should ask themselves—and each other—twelve questions about recession readiness.

FOUR ACTIONS, EXPLAINED

Click below to read more about the implications of the actions outlined above and how they can be applied in any organization

When tough times hit, some companies struggle or even die; some muddle through; and a few thrive. Which group you’re in isn’t a matter of luck. It’s a matter of how well you prepare and how determined you are to act on what you see.

WANT TO CONTINUE THE CONVERSATION?

Connect with our experts

|

The pace at which disruption is forcing change is truly unprecedented.

Is your business prepared?

Sign up to receive insights like this in your inbox.