Introduction

Between October 2022 and April 2023, AlixPartners and Norton Rose Fulbright surveyed business leaders from sectors including automotive, mechanical engineering, TMT, power generation, chemicals, retail and consumer goods. The majority of those we interviewed (69%) were individuals in executive positions, ranging from management roles and M&A, to strategy and corporate law. Of the corporations surveyed, 43% were active in up to 20 countries, with more than a fifth (22%) operating in more than 60 nations. The largest share of those participating was based in Germany (82%), with the remainder basing their operations in Switzerland and Austria.

To ensure our dataset provided the most accurate findings, we focused on individuals with experience in carve-out transactions. Almost half (46%) had been involved in up to three transactions, a further 31% in between four to nine transactions and 19% involved in at least 10 transactions. Around 14% of participants were financial investors with a particular focus on carve-out situations. In each question, respondents were given the opportunity to provide multiple responses.

Key findings

Carve-out and M&A processes are closely interlinked

and serve to focus on transformation

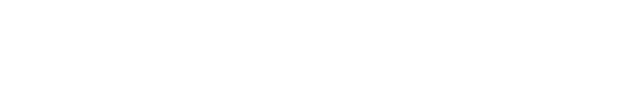

88% of participants use a carve-out to focus on the core business. Additional drivers identified by participants included, to increase target profitability of their group (40%) and to evolve and adapt the company’s business model to achieve transformation objectives (72%).

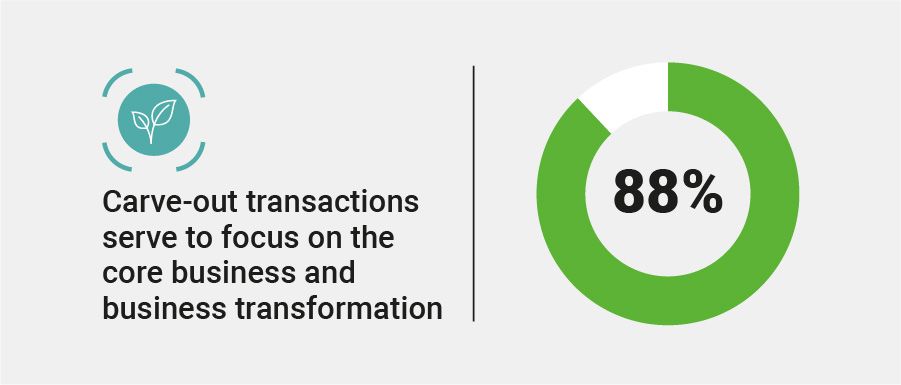

63% of participants indicated that they routinely consider the implementation of possible alternative strategic actions in the run-up to deciding whether to proceed with a carve-out. Others (29%) reported examining this depending on the complexity of the potential transaction. Internal restructuring measures, closures of operations, relocation, joint venture or the transfer of business activities to management (MBO) are alternatives frequently considered.

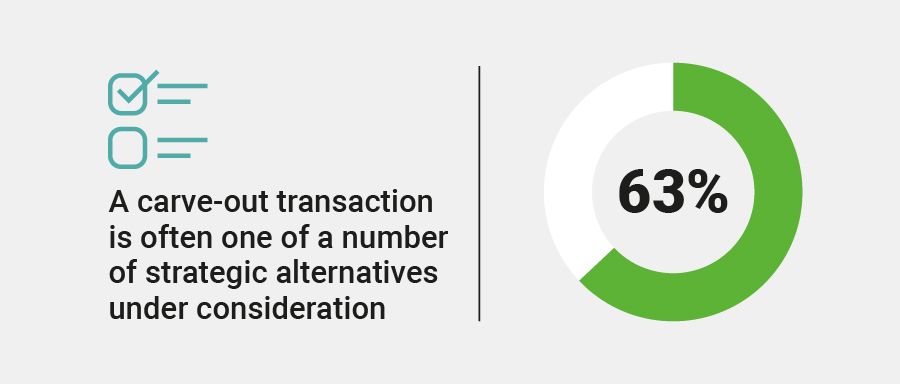

77% of participants associated a carve-out with an onward sale of the carve-out business to an external investor. Purely internal restructuring is typically a minor motivation for a carve-out.

Effectively managing a carve-out’s inherent complexity and realizing value-enhancing measures are key success factors

75% of participants consider the products and services of the carve-out business as the core of the TOM. Other important features include the degree of entanglement between the carve-out business and the wider seller group, employees, processes and customer relationships.

58% of participants plan and implement value-enhancing measures in the run-up to the transaction, however 36% denied doing so. Carve-outs offer potential: measures favoured included cost-reduction programs (59%), working capital optimization measures (44%), and sales improvement programs (41%).

71% of participants consider the entanglement between the carve-out business and the seller group as a key challenge compared to traditional sale situations, followed by 64% who said separation of IT systems, and 51% who chose the complexity inherent in the carve-out.

Disruption drives action and is underpinned by

an expected increase in carve-out activity

72% of participants identified ensuring day one readiness as key to a carve-out transaction’s success. The second most important success factors mentioned a rest ability of sales and achieving the target valuation of the carve-out business (50%). Other success factors identified included: having a clear communication strategy (55%) and limiting the group of people involved (48%).

68% of participants identify the lack of a viable TOM and/or a clearly structured and realistic business plan as the main risks to achieving a successful carve-out transaction. Other risks identified included a lack of transparency with regards to the carve-out structure, insufficient (internal) resources, and compliance breaches (37% each).

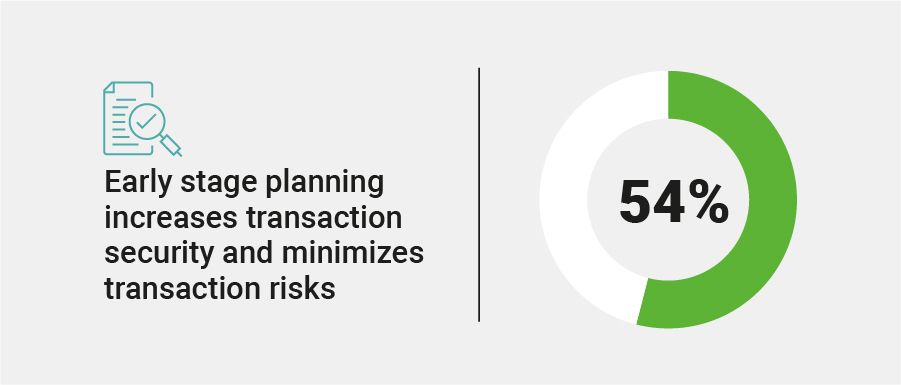

Compared to traditional M&A, the legal transaction structuring (54%), the structuring of the actual carve-out (35%), and the provision of transitional service agreement (TSA) structures (65%), are identified as key distinguishing factors by participants. Stricter warranties in respect of legal relationships material to the carve-out business (45%), purchase price reductions (41%), earn-out components and additional closing conditions (38% each), are required by buyers in light of the greater uncertainty perceived to be inherent in carve-out structures.

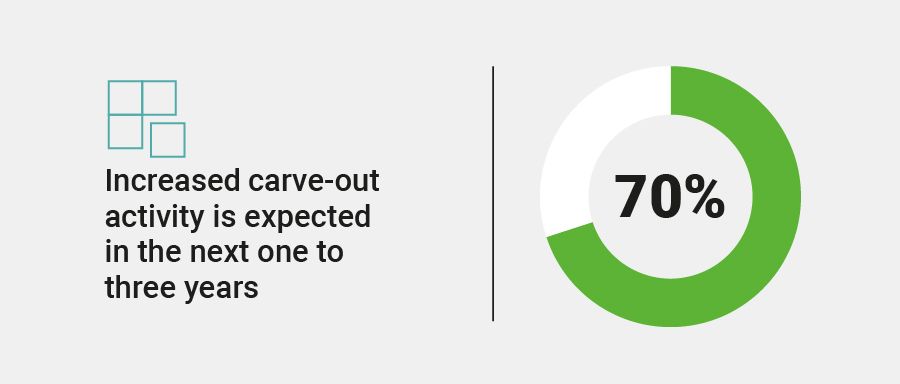

70% of participants expect the number of carve-out transactions to increase in the next 12-36 months. Specifically, the automotive supply (64%), mechanical engineering (42%) and energy (42%) industries are expected to see a rise in carve-out transactions – the drivers being the transformation of business models and a focus on core business activities (72% each).

Expert Videos

Contact our experts

Reach out to our experts for further information.

Michael Wabnitz

Partner & Managing Director, AlixPartners

mwabnitz@alixpartners.com

+49 172 8 55 59 66

Philipp Schult

Director,

AlixPartners

pschult@alixpartners.com

+49 152 0 81 80 193

Karsten Kühnle

Partner, Norton Rose Fulbright LLP

karsten.kuehnle@nortonrosefulbright.com

+49 174 335 91 61

Dr. Michael Prüßner

Partner, Norton Rose Fulbright LLP

michael.pruessner@nortonrosefulbright.com

+49 171 16 633 62