BELIEFS, BEHAVIORS AND RESULTS

All publicly traded companies seek to deliver superior shareholder returns over time. Fewer than two percent have. Those who succeed display five similar traits.

Superior performance is the result of a superior approach to management, as demonstrated by CEOs who have delivered superior shareholder returns over extended periods of time.

Almost every chief executive is focused on delivering superior returns for their shareholders. Yet, few corporations have actually done so, let alone sustained that performance for any length of time. In fact, over the last thirty years only two percent of Fortune 500 companies have been able to deliver shareholder returns in the top quartile of their industries for five consecutive years. Why?

Most academics will cite the overwhelming forces of competition that constantly work to level the playing field and revert the performance of any company to the mean. While competitive forces certainly exist, this response ignores the performance of chief executives who have delivered returns far in excess of their peers over extended periods of time and, in some cases, for more than one company during their careers.

These CEOs will tell you that it is not competition that places the greatest limits on shareholder value growth. Rather, it is management misconceptions about what actually drives shareholder value and how to effectively manage its growth that are the most significant obstacle.

Managers in every corporation carry with them deeply held beliefs about how their company should be run. Some of these beliefs are rules of thumb accumulated over years of industry experience, while others have been absorbed from their mentors.

Yet, few of these beliefs are the outcome of deliberate efforts to sustainably create more value for customers and capture more market profits than competitors to generate more wealth for reinvestment or return to shareholders. As a result, many of these beliefs are standing in the way of doing so.

CEOs of companies that have delivered superior returns over long periods of time emphasize that sustainable improvements in corporate performance begin by confronting management misconceptions and establishing the right set of beliefs. After all, it is these beliefs that influence the behaviors of hundreds, if not thousands, of managers across an organization and ultimately determine the results a corporation delivers over time.

The most successful CEOs not only think and act like owners themselves, they also cause managers across their companies to do the same. Not by demanding their employees slavishly execute their directives, but by establishing a set of guiding principles and organizational conditions that support superior decision making and execution.

FIVE CORE PRINCIPLES

1. ESTABLISH THE RIGHT DEFINITION OF WINNING

The ultimate objective of a publicly-traded company is to deliver superior returns over time for its stockholders.

While revenue, earnings and return on capital are important measures of performance, it is ultimately the growth in cash flow and economic profit that drives shareholder value.

All leaders of successful organizations have one thing in common: they have established an unambiguous and singular definition of winning. Their organizations are absolutely clear on what they are trying to achieve and how they will ultimately measure success. It is impossible for an entire organization to keep rowing in the same direction without such clarity. It is just not feasible for a single person or group of people, no matter where they are in the organization, to make a consistent set of decisions and trade-offs over time without a consistent definition of winning, measure of success and criterion for making strategic and resource allocation decisions.

IN ORDER TO WIN IN BOTH THE CUSTOMER AND CAPITAL MARKETS, COMPANIES MUST:

1. Create greater customer value by doing a better job than competition at satisfying customer needs

2. Create greater shareholder value by capturing more market profits than the competition

With a greater share of market profits, companies establish a reinvestment advantage that allows them to invest more in differentiating their offer and developing their markets than the competition. This reinvestment advantage creates a virtuous cycle that allows the best-performing companies to continue building and sustaining their competitive advantage over time.

2. CAPITALIZE ON CONCENTRATIONS OF VALUE

We all remember the famous quote from John Wanamaker, the man who created some of the first department stores on the East Coast: “Half the money you spend on advertising is wasted; the trouble is that you don’t know which half.”

Unfortunately, for most CEOs, the same statement applies to the human and capital resources that are invested across their company. In many Fortune 500 companies, less than 40 percent of the capital employed in the corporation is generating over 100 percent of the company’s shareholder value, while 25 to 35 percent of the capital employed is destroying shareholder value.

Most executives simply don’t believe that statement. And why should they, when they have spent their entire careers looking at management reports of aggregate operating profits instead of economic profits at a much more granular level? Typical management accounting systems provide neither a complete view of profitability nor a granular enough view of business segment economics.

And yet, economic profits, shareholder value contribution and, most importantly, profitable growth potential are always concentrated by market, by company, by business, and by business segment (i.e. at the intersection of products, customers, channels, etc.).

Why? Because of differences in market conditions (such as customer needs and buying behavior, competition, regulation, macroeconomic conditions) that impact the size and growth of the available economic profit pool, and because of differences in the competitive position that determine how much share of the profit pool businesses participating in each market will capture.

This concentration of value and growth potential is why there is such enormous potential to grow the value of most corporations. Understanding where and why economic profits are concentrated, and how that concentration is likely to change in the future, provides management with a tremendous advantage in deciding where to invest time, effort and capital.

3. MANAGE TO A VALUE GROWTH AGENDA

Most companies do not have an explicit, quantified corporate value improvement agenda. Instead, they may rely on a mission statement or corporate strategy they hope will guide behavior and the overall direction of the company. For example, one Fortune 500 company’s mission statement is “to combine aggressive strategic marketing with quality products and services at competitive prices, to provide the best value for customers.” While aspirational, such general statements of strategic intent are not specific enough to focus top management’s attention on the things that will create the most value for customers or the company. As a result, they do not provide a means for setting priorities, making trade-offs and tracking progress.

Instead, the best CEOs often think of their companies as an activist investor might. Their mantra: “Our objective is to find the most value growth in the shortest period of time possible.”

Jim Kilts (who as CEO turned around the performance of three of the world’s most notable consumer brand companies: Kraft Foods, Nabisco, and Gillette) calls it staying focused on “doing what matters.” As he describes, “It takes guts to say these are the things that really matter and I’ll pay absolutely no attention to the rest. When you’re young and impulsive, everything seems possible. Even doing everything at once doesn’t seem daunting. But experience teaches you that nothing gets done when you try to do too much. You either whirl around in circles or slump into paralysis when facing endless options simultaneously.”

4. DIFFERENTIATE STRATEGIES AND ALLOCATE RESOURCES DIFFERENTIALLY

Strategies need to be more than qualitative statements of intent. They must be specific descriptions of where and how a business intends to outperform the competition in creating greater:

1. Customer value, by better satisfying customer needs, and

2. Shareholder value, by capturing more of the economic profits in each market.

CEOs who have delivered superior customer and shareholder value emphasize that strategies must define how a business will differentiate itself from the competition in order to capture a leading share of the economic profits. However, far too many business strategies do nothing more than define the steps that will be taken to incrementally improve performance, in effect describing how a business will continue to do what it has been doing, only a bit better.

What’s wrong with that? Well, at one level, nothing. Continuous improvement is a good thing. But since you have to assume the competition is going to be doing that as well, you need to ask yourself a different question, namely, “Is the business strategy we’re trying to optimize actually the best business strategy?”

Most companies don’t ask that question. Without really being aware of it, they are assuming they are already marketing and selling the right products, at the right price, to the right custom ers, through the right channels, with the right supply-chain configuration and cost structure. But what if they aren’t? Then they are spending all their time trying to optimize a sub-optimal business strategy.

It is important to recognize that differences in competitive position are seldom driven by differences in operating efficiency; they are primarily driven by different choices companies make about where and how to compete. So before you start trying to optimize performance, ask yourself whether you are pursuing the right business strategy.

How do you know? It boils down to this: if the business is gaining share of economic profits in a market, then it is pursuing an advantaged strategy. If it is losing share of economic profits, it isn’t.

5. BUILD THE ORGANIZATIONAL CONDITIONS AND CAPABILITIES TO MANAGE VALUE

As the CEO, you and your executive team face two challenges in delivering and sustaining superior shareholder value growth. First, you need to ensure the strategies and resources are in place to maximize the economic profit growth of each business unit and the entire corporation. Second, you must establish the organizational beliefs and conditions to sustain that discipline and increase the odds that the daily decisions and actions of employees across your company are aligned with shareholder interests. You need to instill this behavior deep in the organization because, after all, you and your executive team cannot possibly be personally involved in every decision that influences corporate performance.

Getting your managers to focus on and actually achieve economic profit growth takes more than just introducing a new measure of profitability and linking it to compensation.

Peter Drucker rightly said that “culture eats strategy for breakfast”. But cultural change is difficult. CEOs who have guided their organizations through these changes offer some suggestions. Miles White, Chairman and CEO of Abbott Labs, notes, “To make changes of this magnitude, you need to recognize this is about changing the way you manage the company. It’s decision processes. It’s what you measure. It’s what you reject. It’s what you reward. You have to be consistent with everything.”

White reminds us, “All organizations have their habitual DNA, so migrating away from those past practices and toward the new ones you want takes more time than you would like. And while you’re going through the transition, people have the tendency to hang onto older practices because they’re safe and understood. That slows you down and it’s a competitive, tough world. You don’t want that.”

“How do you get your management teams to move faster? You keep putting in front of them the same themes, the same tests, the same metrics, the same measures, the same comparisons. You prod them with the benchmarks of either competitors or what’s possible. And you push. You push with incentives and with what you talk about, and what you emphasize in your staff meetings. It’s one hundred different things. But it’s got to be consistent. You’ve got to keep a certain urgency around it.”

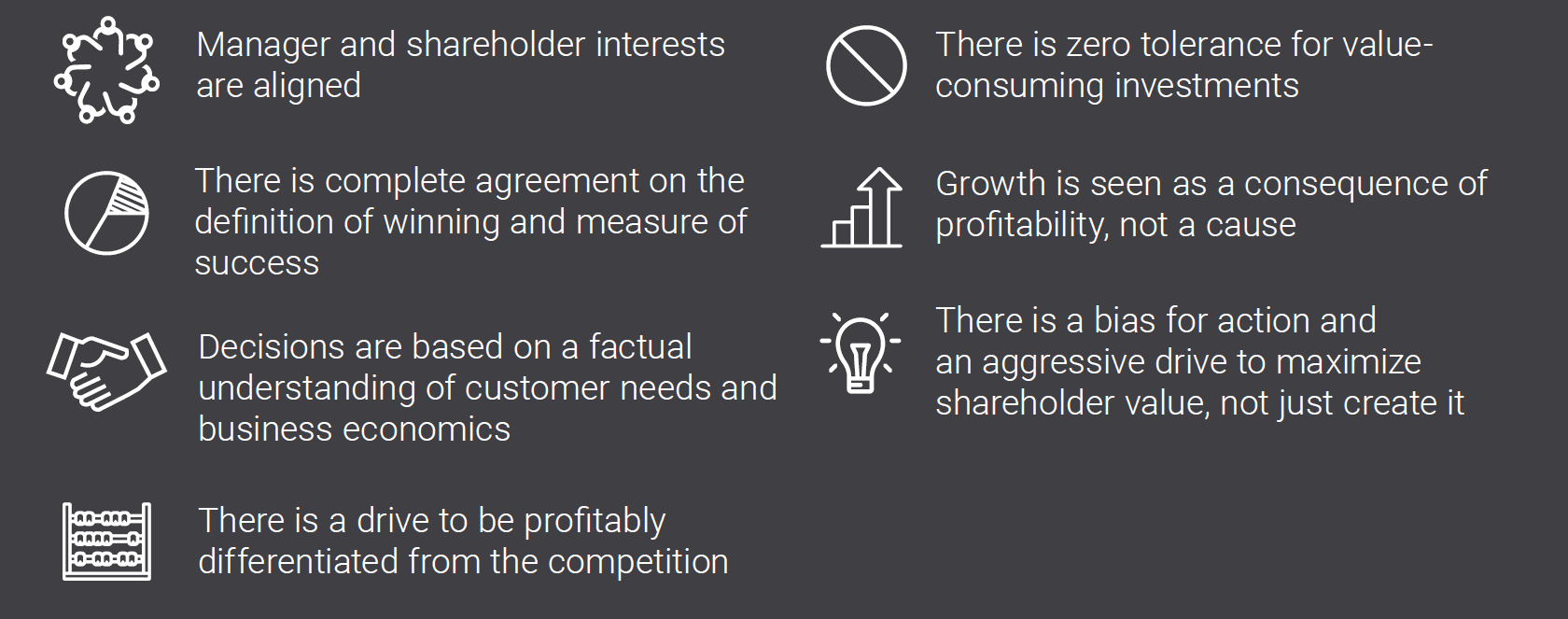

BUILDING THE ORGANIZATIONAL CONDITIONS AND CAPABILITIES TO MANAGE VALUE REQUIRES CONSISTENT ALIGNMENT OF ALL ORGANIZATIONAL CONDITIONS THAT IMPACT MANAGEMENT BEHAVIOR SO THAT:

GETTING STARTED

Winning is ultimately defined by sustaining higher shareholder returns than your competition. In order to win in the capital markets, you must do a better job of creating value for your customers and capturing it for your shareholders. If you do, you will realize higher cash flow and economic profit growth than your competition.

Shareholder value contribution and growth potential are always concentrated. Understanding where and why offers you a tremendous opportunity to focus your strategies and resources on creating and capturing more of the economic profits in every market you serve, thereby building a formidable reinvestment advantage difficult for competitors to match.

There are only a handful of opportunities to significantly impact economic profit growth. Keeping time, talent and resources focused on the ones that matter most is the way to run the company.

Good performance is the result of doing things better. Superior performance is the result of doing thing differently. To maximize shareholder value, businesses must develop differentiated strategies and differentially allocate their resources.

Shareholder value is impacted by the daily decisions of hundreds of managers. Adopting the beliefs and establishing the organizational conditions that align these decisions with shareholder interests is the only way to sustain superior performance.

OUR CORPORATE STRATEGY & TRANSFORMATION TEAM

Our Corporate Strategy & Transformation team believes that the best measure of a company’s success is sustaining superior shareholder returns compared to industry peers. We bring the disciplines of the capital market inside a corporation and enable managers at all levels to grow the shareholder value contribution of their businesses.

Our work impacts corporate and business unit strategies, resource allocation, performance management – and intentionally builds a company’s ongoing management capabilities to sustain superior performance.

We believe that outside advisors should build clients’ capabilities – not replace them. Through lasting improvements in management capabilities, decision processes and standards, companies can compound their reinvestment advantage over many years.

“Scott, Lee, Joe, and team bring a unique combination of

analytic rigor, strategic insight and practical implementation skills that allows them to bridge the gap between recommendations and results.”